Here are all my highlights from the newest report by WEF.

I usually highlight interesting phrasings or fresh insights that i discover in specific materials like this one.

navigate the complex transitions ahead

Key findings

Increasing cost of living ranks as the second most transformative trend overall

declining working age populations

increased restrictions on trade and investment

re-shore

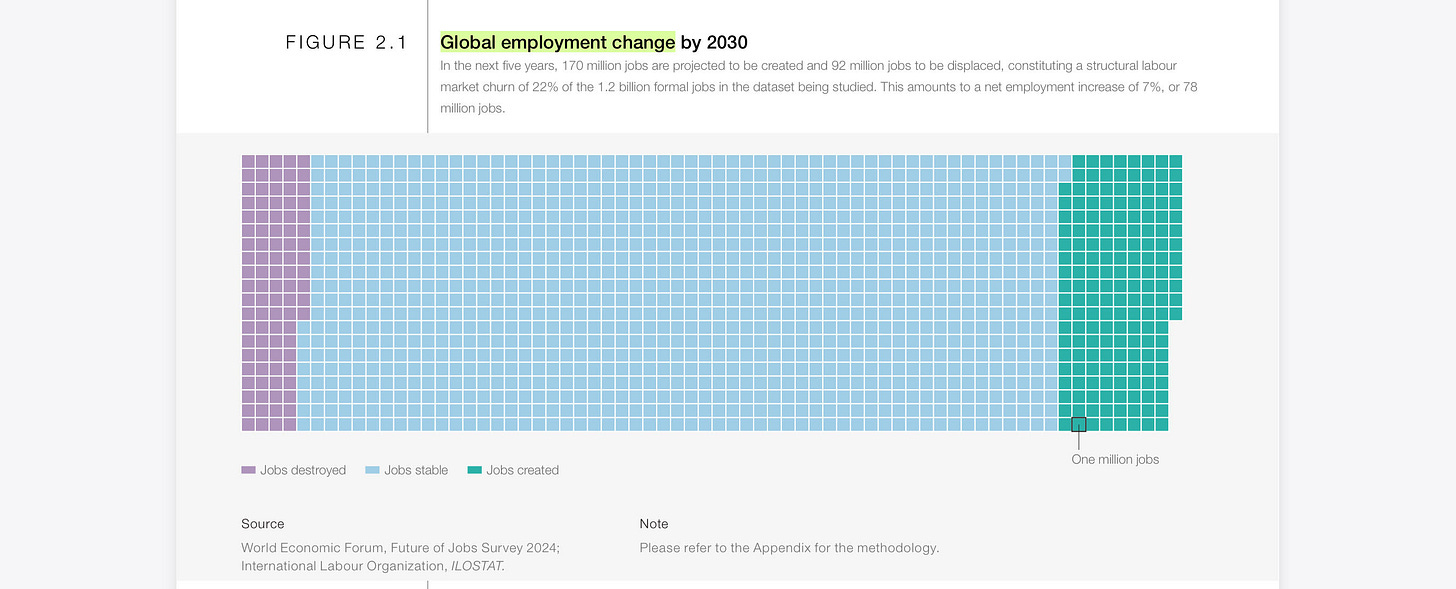

job creation and destruction due to structural labour-market transformation will amount to 22% of today’s total jobs

workers can expect that two-fifths (39%) of their existing skill sets will be transformed or become outdated over the 2025-2030 period

skill instability

existing and emerging skills differences between growing and declining roles could exacerbate existing skills gaps

the scale of workforce upskilling and reskilling expected to be needed remains significant: if the world’s workforce was made up of 100 people, 59 would need training by 2030.

Of these, employers foresee that 29 could be upskilled in their current roles and 19 could be upskilled and redeployed elsewhere within their organization.

However, 11 would be unlikely to receive the reskilling or upkskilling needed, leaving their employment prospects increasingly at risk.

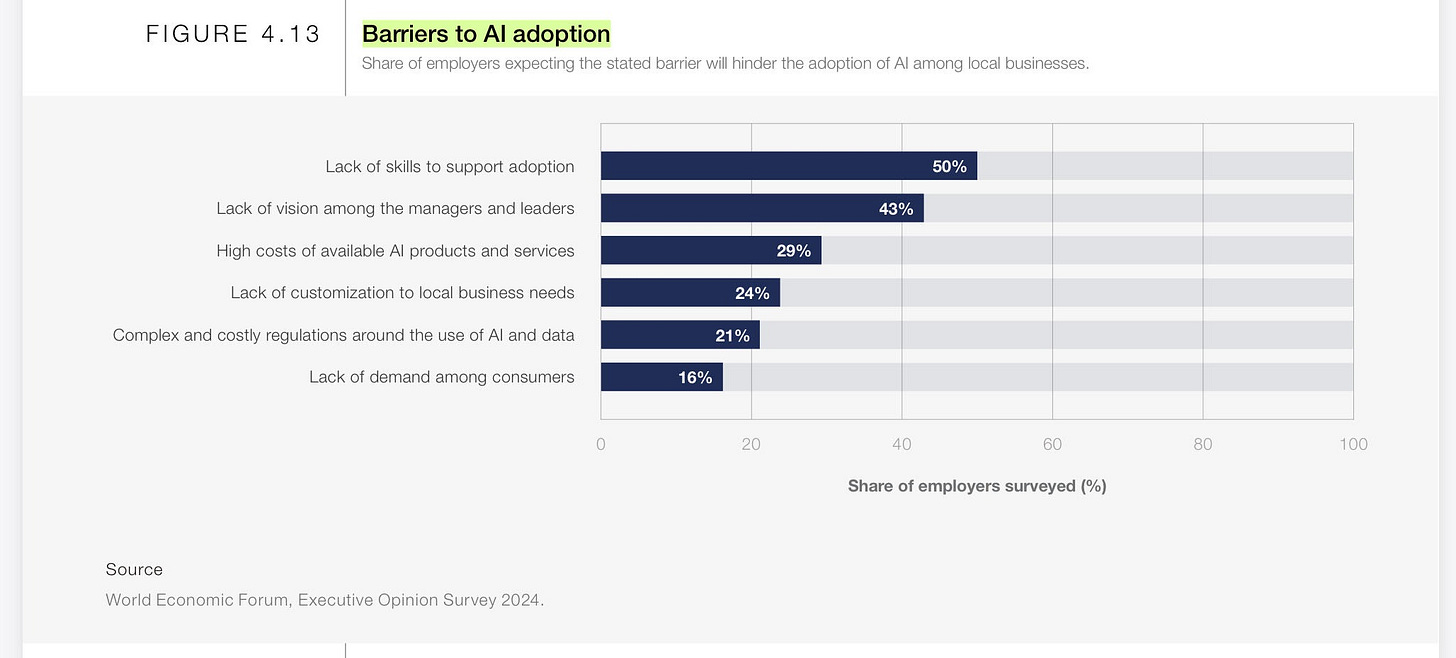

Skill gaps are categorically considered the biggest barrier to business transformation

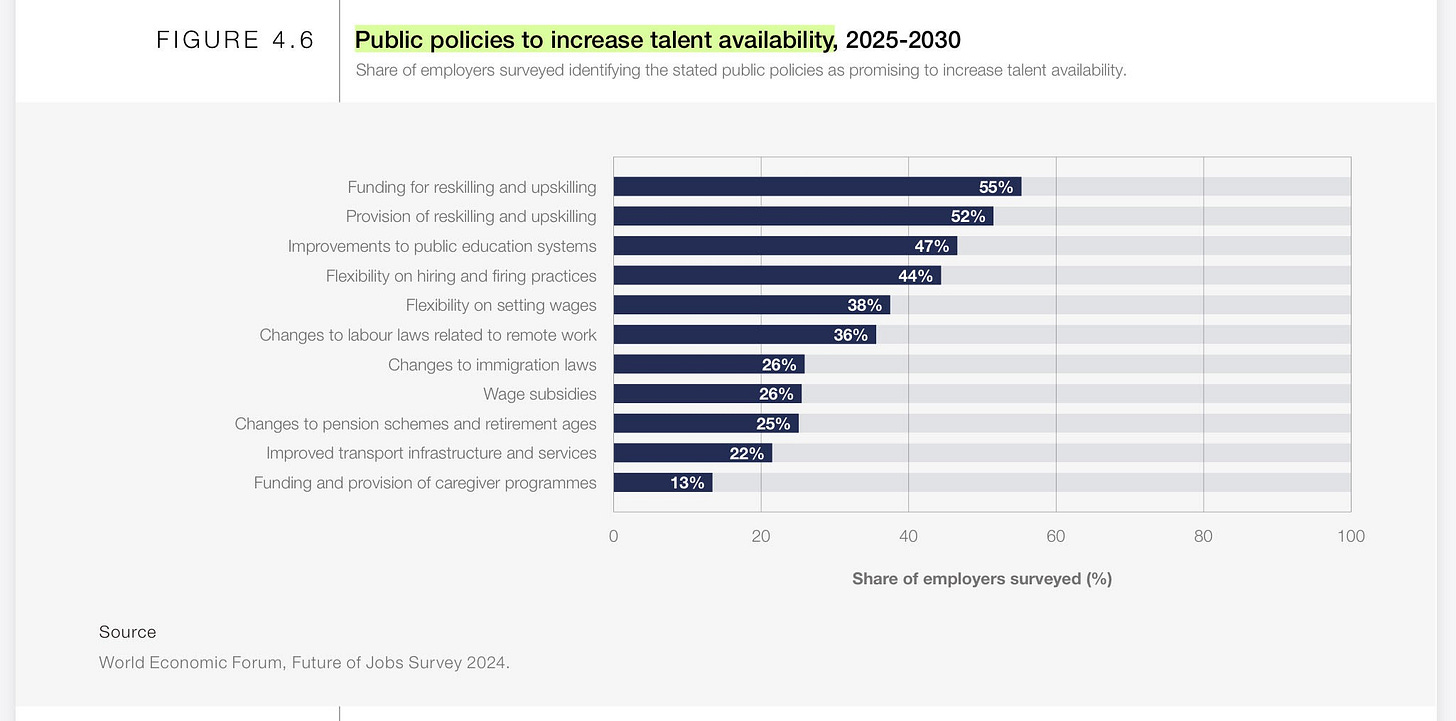

Funding for - and provision of - reskilling and upskilling are seen as the two most welcomed public policies to boost talent availability.

By 2030, just over half of employers (52%) anticipate allocating a greater share of their revenue to wages, with only 8% expecting this share to decline.

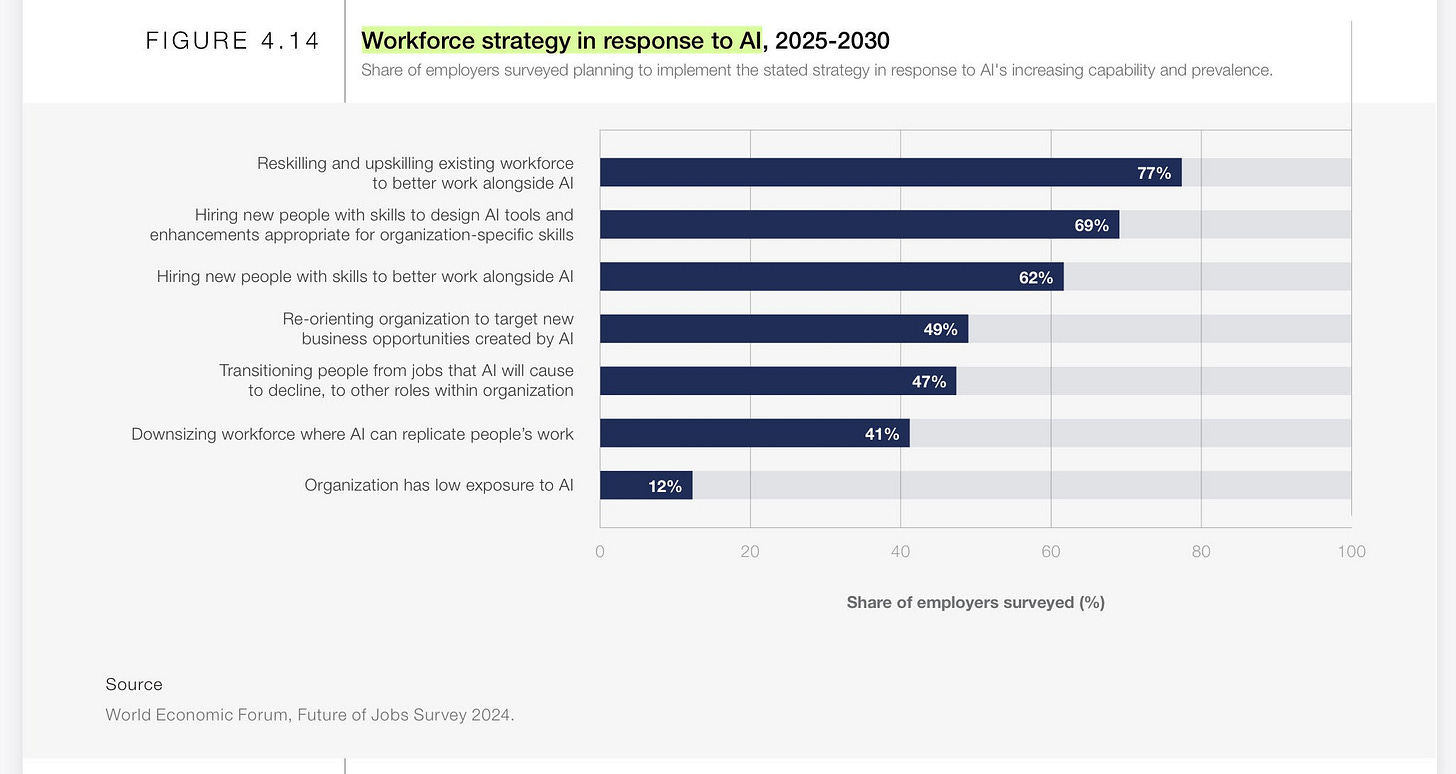

Finally, half of employers plan to reorient their business in response to AI, two-thirds plan to hire talent with specific AI skills, while 40% anticipate reducing their workforce where AI can automate tasks.

Introduction: The global labour market landscape in 2025

While the global NEET rate remains flat at 21.7%, it stands at just 10.1% for high-income economies, rising to 17.3% for upper-middle income ones. The rate then jumps to 25.9% for lower-middle income economies and 27.6% for low-income ones.

lower-middle income economies – who make up around 40% of the global population – will drive the bulk of working-age population growth in the coming years and decades

1. Drivers of labour-market transformation

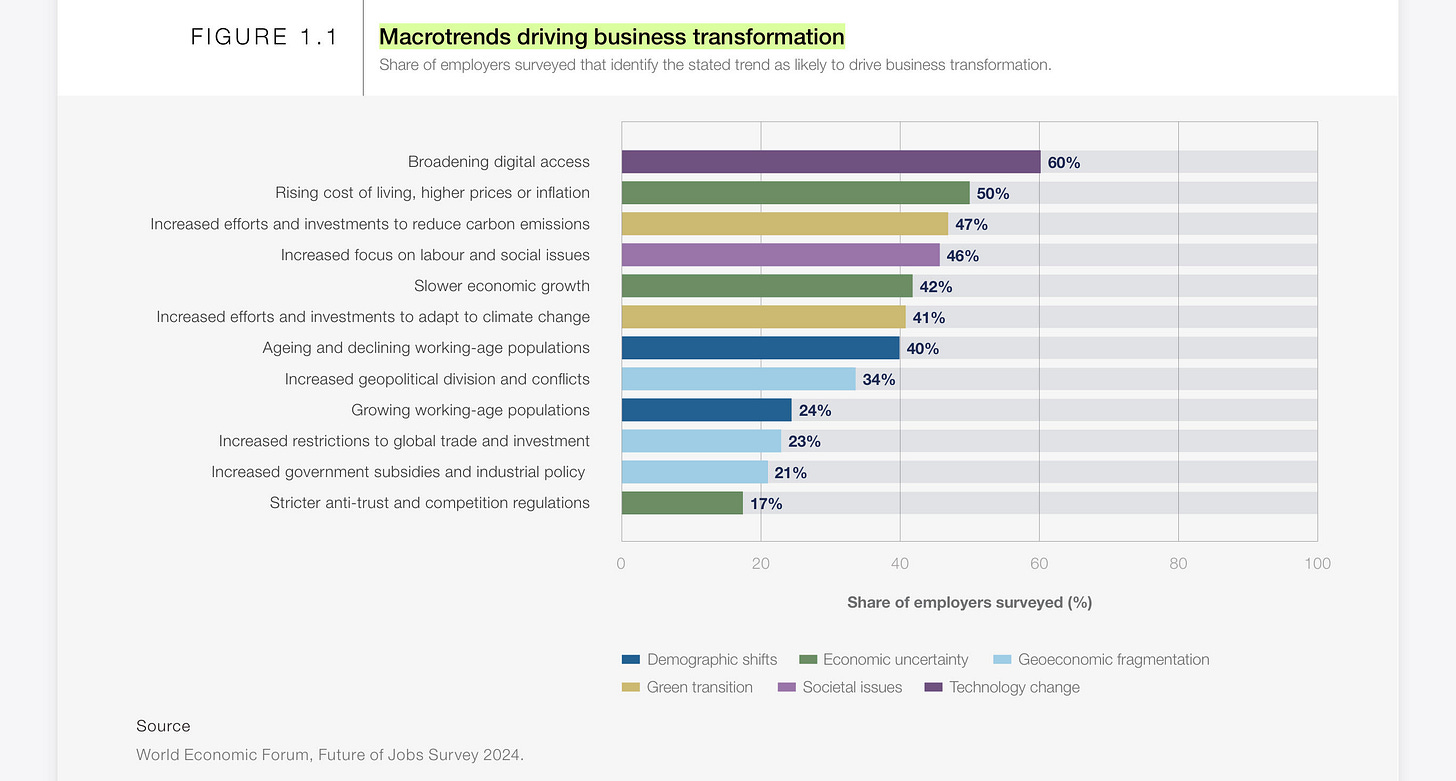

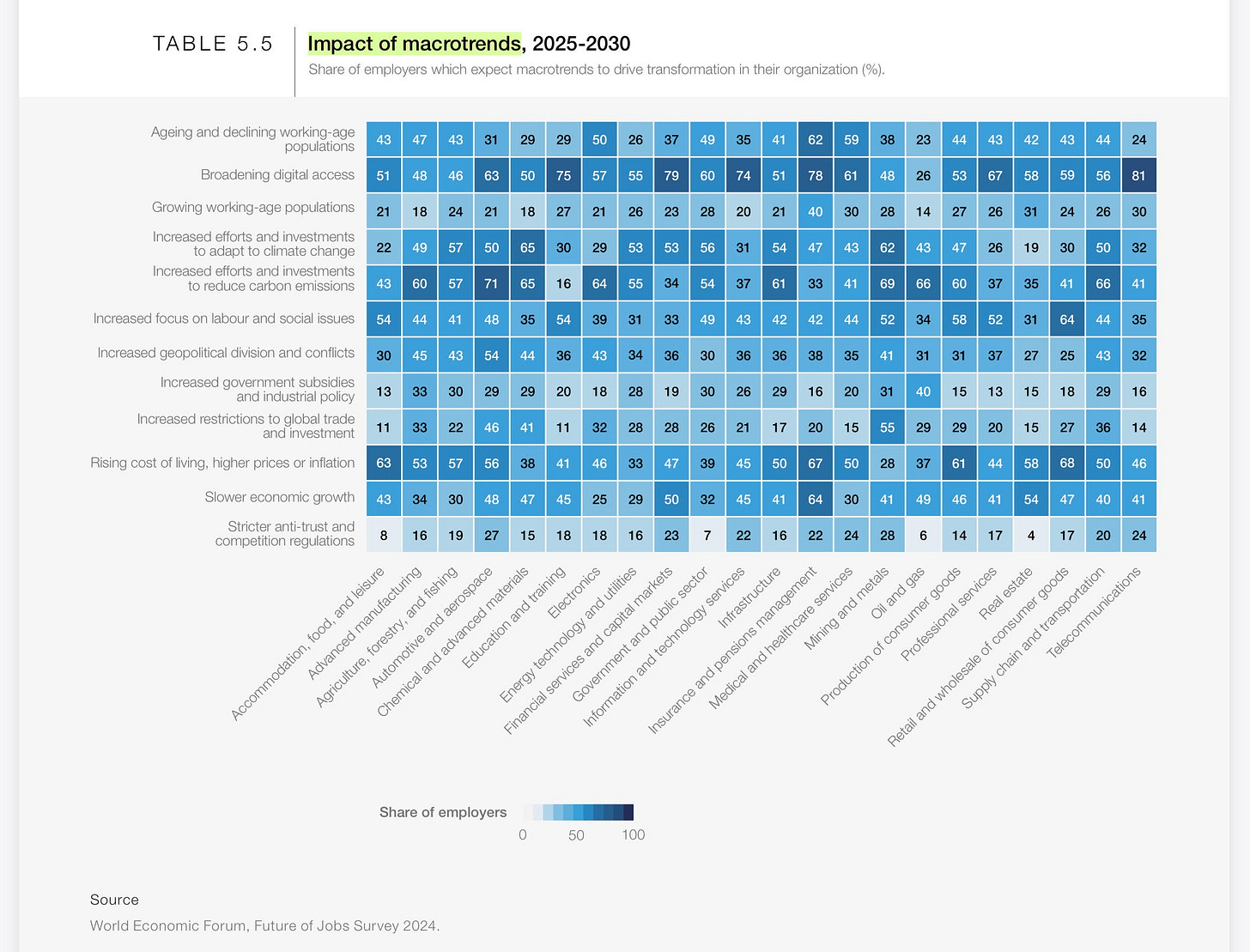

Expected impact of macrotrends on business transformation

Technological change

While the full extent of long-term productivity gains from the technology remains uncertain, workplace studies have identified various initial ways for generative AI to enhance human skills and performance.

Other studies have shown generative AI can enhance knowledge work if applied appropriately within its capability, but risks producing adverse outcomes where users unknowingly stretch it beyond its capability

the technology could equip skilled professionals such as Electricians, Doctors or Engineers with the world’s forefront knowledge – enabling them to solve complex problems more efficiently.

without appropriate decision-making frameworks, economic incentive structures and, possibly, government regulations, there remains a risk that technological development will be focused on replacing human work, which could increase inequality and unemployment

Currently robot installations are heavily concentrated, with 80% of installations occurring in China, Japan, United States, the Republic of Korea, and Germany

Demand for generative AI skills

Demand for AI skills has accelerated globally, with India and the United States leading in enrolment numbers.

However, the drivers of demand differ.

In the United States demand is primarily driven by individual users, whereas in India, corporate sponsorship plays a significant role in boosting GenAI training uptake.

Institution-sponsored learners, on the other hand, emphasize practical applications within the workplace, including leveraging AI tools to enhance efficiency in Excel or leveraging the technology to develop applications.

individuals focus on foundational knowledge-building while organizations prioritize training that delivers immediate workplace productivity gains.

Economic uncertainty

Most surveyed chief economists (54%) expect economic conditions to hold steady in the short term.

Geoeconomic fragmentation

The World Trade Organization (WTO) reports that trade restrictions doubled between 2020 and 2024, with the value of import restrictions reaching nearly 10% of global imports in 2024.

This shift toward geoeconomic fragmentation carries substantial macroeconomic implications, with the IMF estimating potential global output losses from trade fragmentation ranging from 0.2% to 7% of GDP, and losses deepening in scenarios of technological decoupling.

Emerging and developing economies are particularly vulnerable to such disruptions.

For example, Sub-Saharan Africa could see long-term welfare losses of approximately 4% of GDP due to declining global integration

sectors with a high degree of dependence on global supply chains, such as Automotive and Aerospace (46%), and Mining and Metals (55%), expect industry transformation driven by trade restrictions

The broader implications of geoeconomic fragmentation extend beyond individual business strategies to long-term economic stability and growth, and limit multilateral cooperation on critical issues such as climate change and pandemic preparedness

Green transition

Nearly half of surveyed employers (47%) anticipate the ramping up of efforts and investments to reduce carbon emissions as a key driver for organizational transformation.

the industrial sector – encompassing industries such as Automotive and Aerospace, and Mining and Metals – anticipates significant organizational transformation as companies ramp up efforts to decarbonize: 71% of employers in the Automotive and Aerospace industry and 69% of those in the Mining and Metals industry expect carbon emissions reductions to transform their organizations.

workers requiring upskilling and reskilling to transition to alternative jobs.

As countries seek to meet climate goals, questions arise regarding whether their workforces are equipped with the necessary skills to meet the demands of a net-zero future.

The shift toward sustainable practices will require specialized expertise which will incur transition costs, particularly for those working in production occupations such as assemblers and fabricators

Demographic shifts

In higher-income nations, aging populations are increasing dependency ratios, potentially putting greater pressure on a smaller pool of working-age individuals and raising concerns about long-term labour availability

for 40% of employers worldwide, aging and declining working-age populations are driving transformation

Compared to global averages, employers facing the effects of aging population are more pessimistic about talent availability and expect facing bigger challenges in attracting industry talent.

with a shrinking labour pool, many of these companies (60%) increasingly prioritize transitioning current employees into growing roles as a key workforce strategy

aging high-income economies with shrinking labour forces might increasingly look to deeper automation to counterbalance some of these demographic

employers expecting to be impacted by aging populations are more likely to accelerate process automation (79% versus 73% globally) and advance workforce augmentation (67% versus 63% globally) in the next five years.

many economies’ actual ability to leverage demographic dividends will depend on their accompanying success, or otherwise, in inclusive job creation.

According to the World Bank, over the next 10 years, an unprecedented 1.2 billion young people in emerging economies will become working-age adults, while the job market in these economies is only expected to create 420 million additional jobs – risking leaving nearly 800 million young people in economic uncertainty

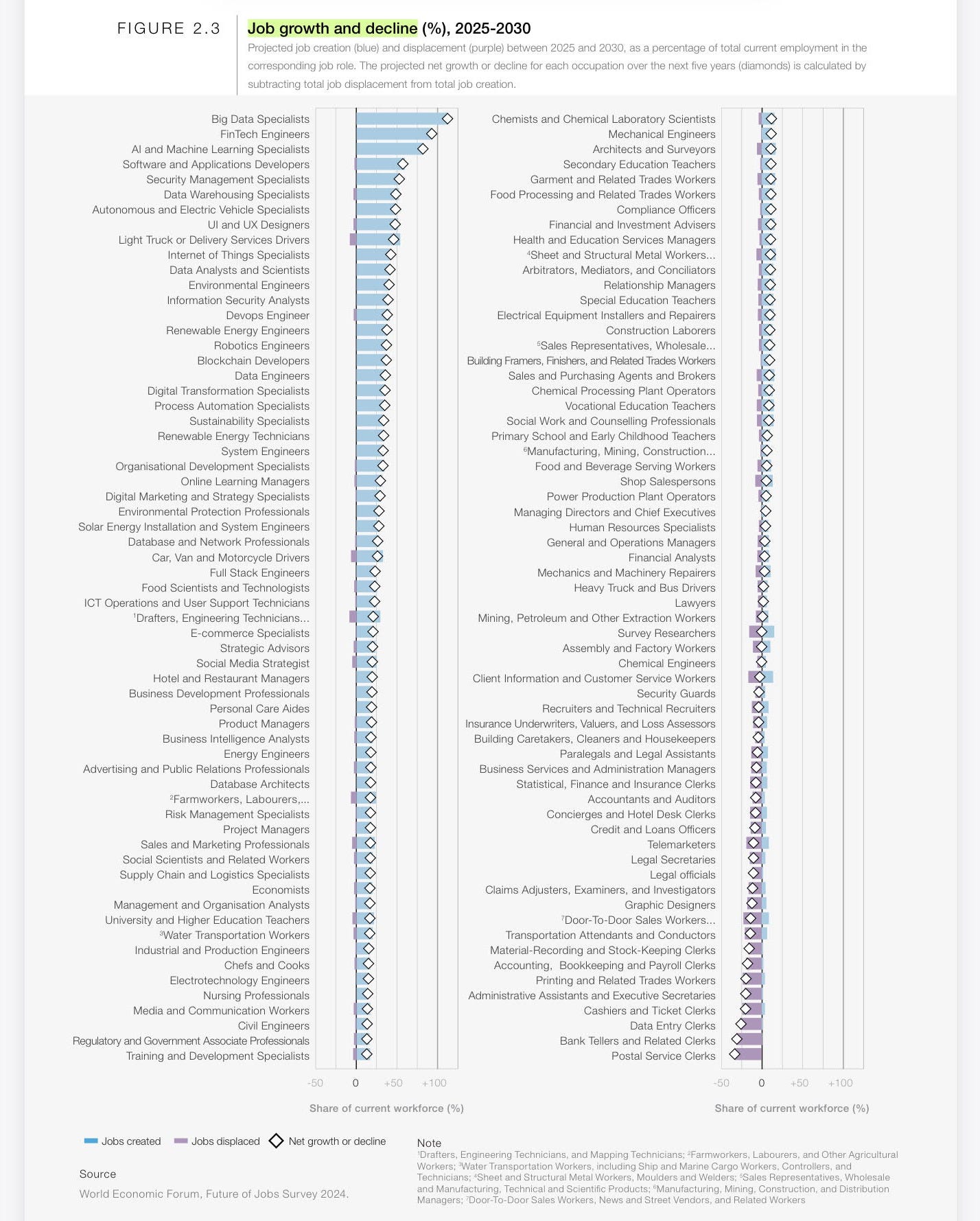

2. Jobs outlook

Total job growth and loss

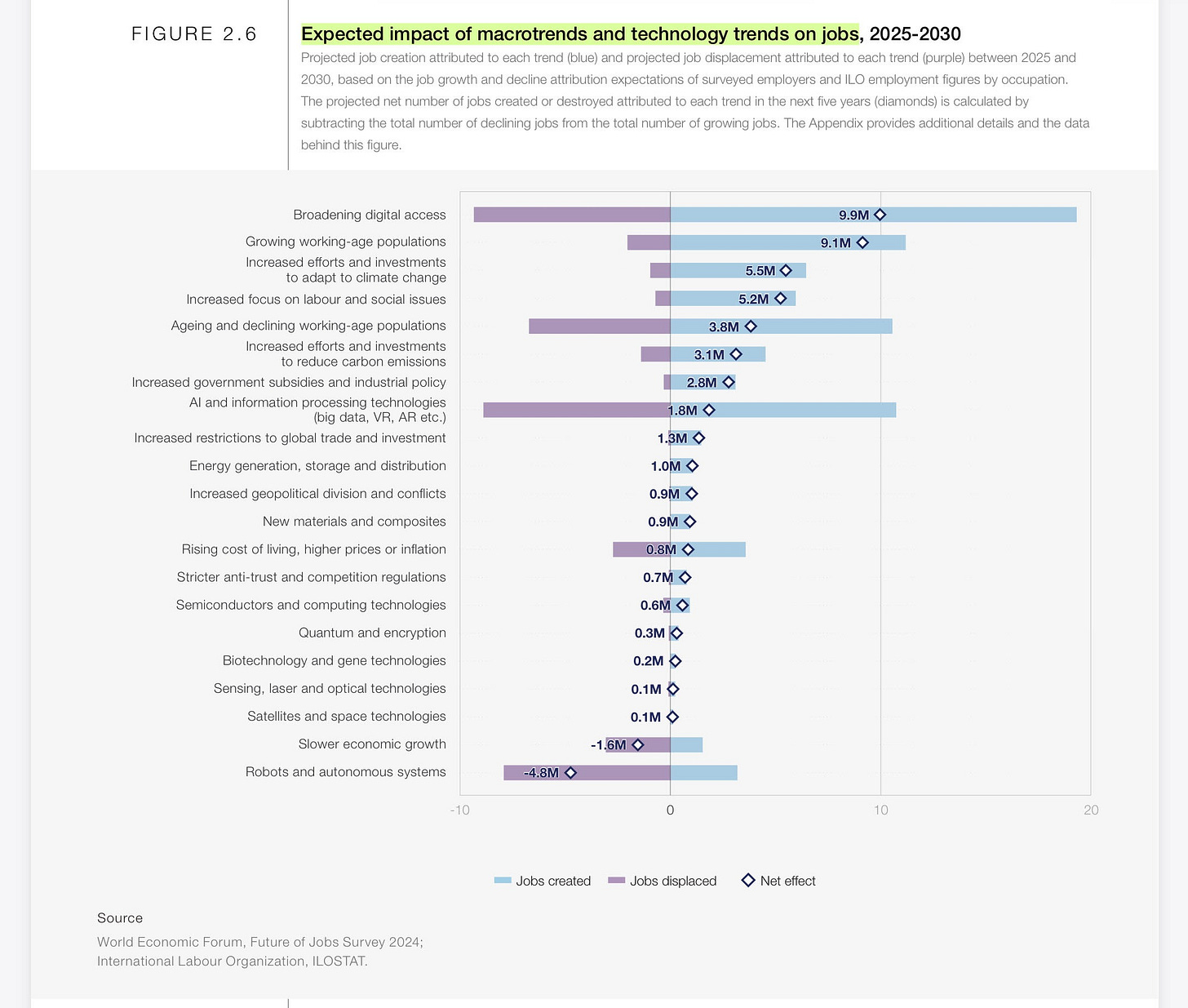

macrotrend-driven creation of new jobs is estimated to amount to 170 million jobs, equivalent to 14% of today’s total employment

growth is expected to be offset by the displacement of 92 million current jobs, or 8% of total employment, resulting in a net growth of 78 million jobs (7% of today’s total employment) by 2030

Expected impact of macrotrends on employment

Technological change

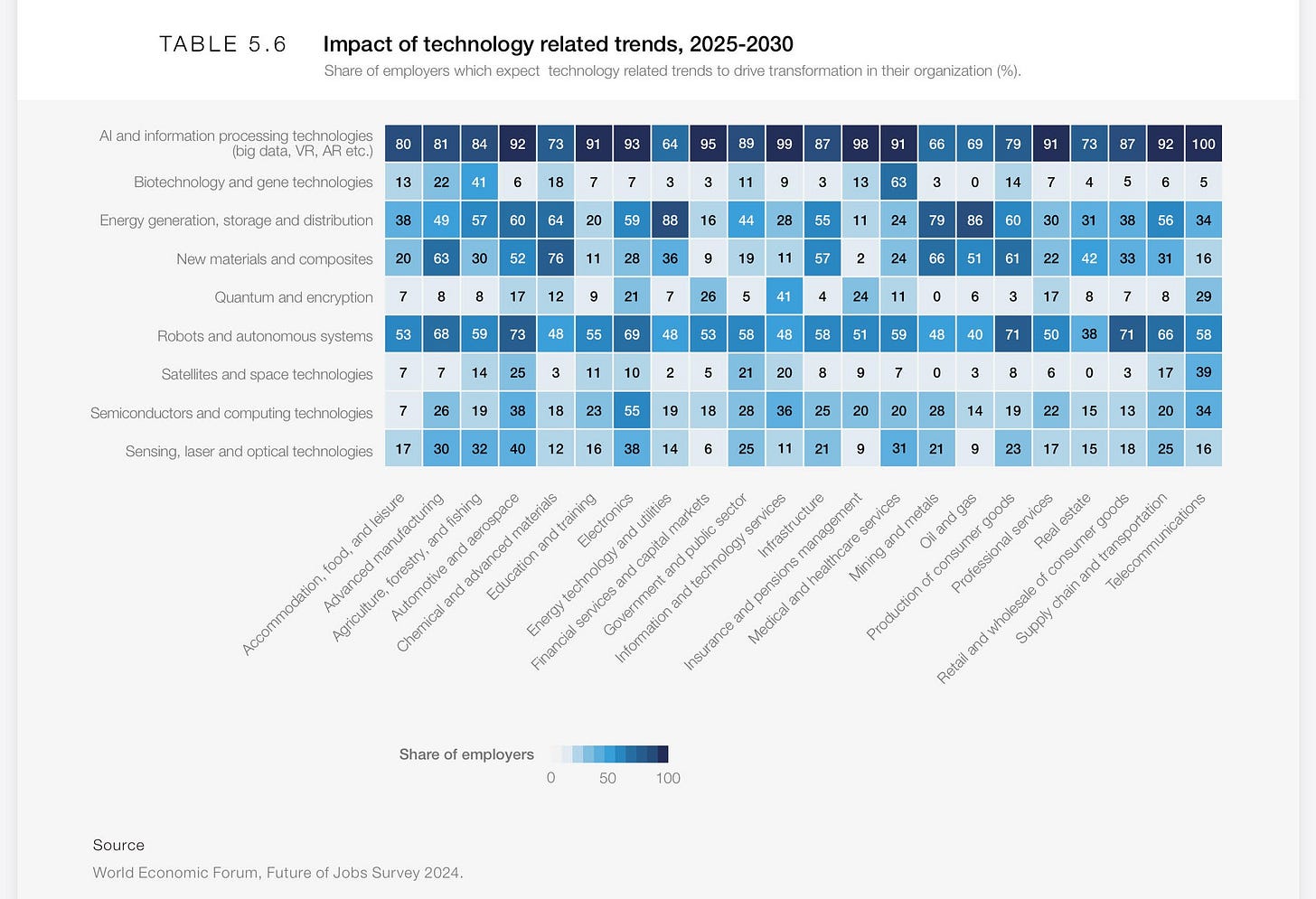

trends in AI and information processing technology are expected to create 11 million jobs, while simultaneously displacing 9 million others, more than any other technology trend.

Robotics and autonomous systems are expected to be the largest net job displacer, with a net decline of 5 million jobs.

The Shifting human-machine frontier: automation versus augmentation

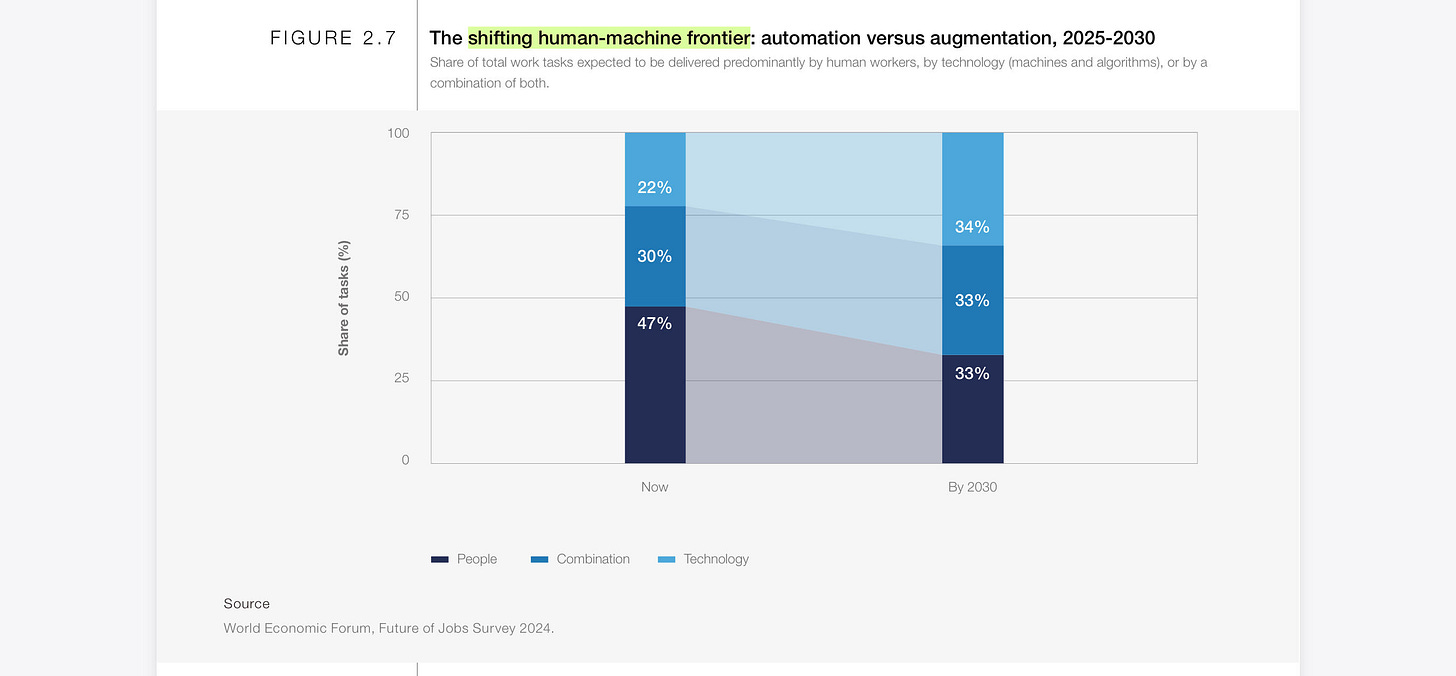

The interplay between humans, machines and algorithms is redefining job roles across industries.

Automation is expected to drive changes in people’s ways of working, with the proportional share of tasks performed solely or predominantly by humans expected to decline as technology becomes more versatile.

Future of Jobs Survey respondents estimate that, today, 47% of work tasks are performed mainly by humans alone, with 22% performed mainly by technology (machines and algorithms), and 30% completed by a combination of both.

By 2030, employers expect these proportions to be nearly evenly split across these three categories/approaches (Figure 2.7).

this analysis only compares the 2025 and 2030 proportions of total task delivery attributable to human employees, technology or collaboration between the two, respectively, and does not consider the potential change in the absolute amount of work tasks (output) getting done

both machines and humans might be significantly more productive in 2030 – performing more or higher value tasks in the same or less amount of time than it would have taken them to do so in 2025 – so any concern about humans “running out of things to do” due to automation would be misplaced.

on-going share of total economic value creation participated in by human workers: If an increasing amount of a firm’s total output and income is derived from advanced machines and proprietary algorithms, to what extent will human workers be able to share in this prosperity?

It is the investment decisions and policy choices made today that will shape these outcomes in the coming years

Geoeconomic fragmentation

The Future of Jobs Survey also asked respondents whether they expected to offshore parts of their workforce, or move operations closer to home through reshoring, nearshoring, or friendshoring

All three geoeconomic trends analysed appear to drive more re-shoring, with respondents who expect their business to be transformed by increasing restrictions to global trade and investment 50% more likely to plan to reshore than the global average employer

Economic uncertainty

Slower economic growth is the only macrotrend that Future of Jobs Survey respondents expect to drive more job destruction (3 million jobs) than creation (2 million jobs), while rising cost of living and higher prices are expected to drive job creation of 4 million jobs and displacement of 3 million jobs by 2030.

These two trends are both significant contributors to an expected decline in roles for Building Caretakers, Cleaners, and Housekeepers, while slower economic growth is also among the top contributors to job decline in Business Services and Administration Managers, General and Operations Managers, and Sales and Marketing Professionals.

However, slower economic growth is also projected to be a top driver for growth in roles such as Business Development Professionals and Sales Representatives.

Growth in roles driven by increasing cost of living is concentrated in jobs associated with finding ways of increasing efficiency, such as AI and Machine Learning Specialists, Business Development Professionals, and Supply Chain and Logistics Specialists.

3. Skills outlook

Expected disruptions to skills

skills instability

enabling companies to better anticipate and manage future skill requirements

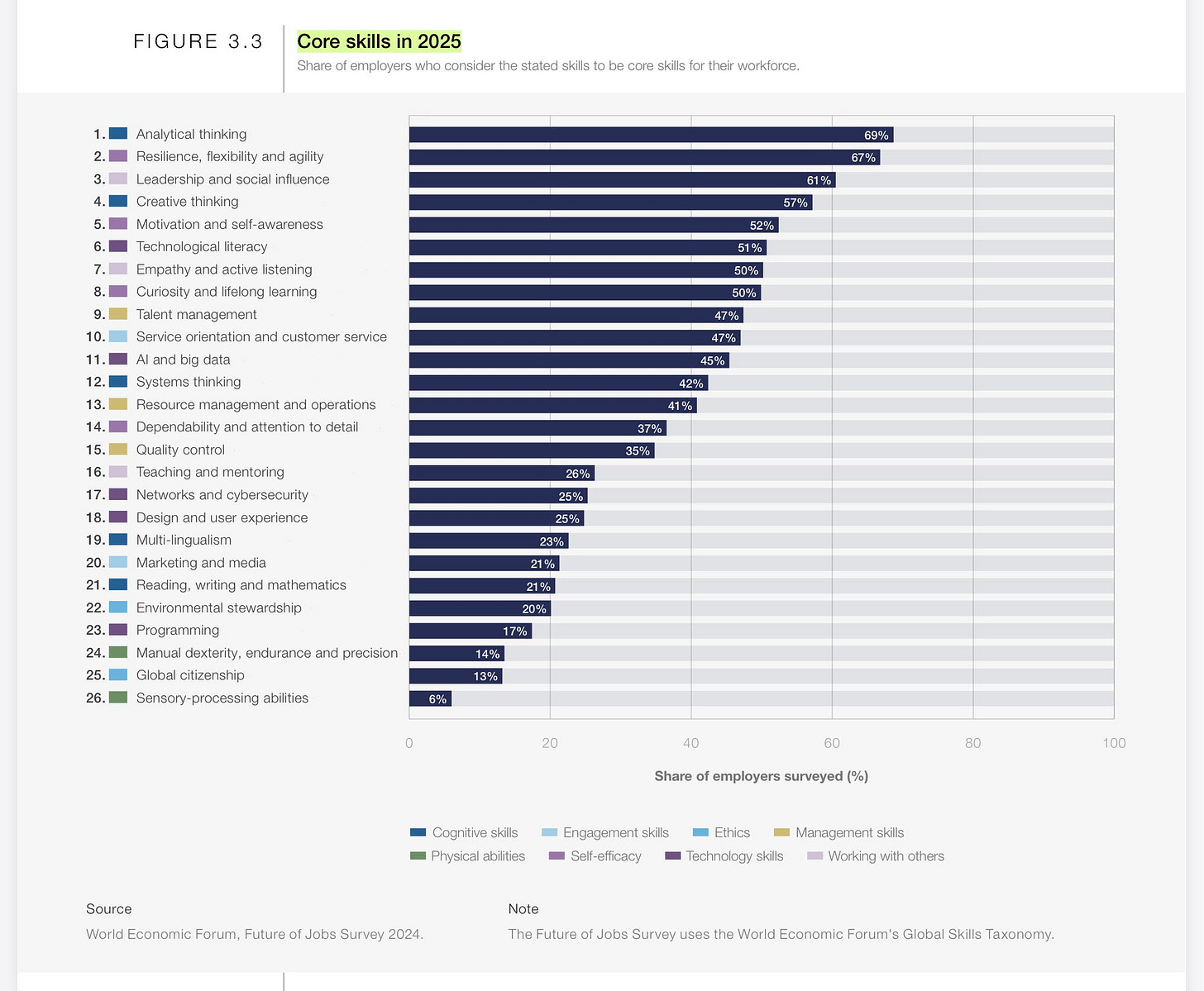

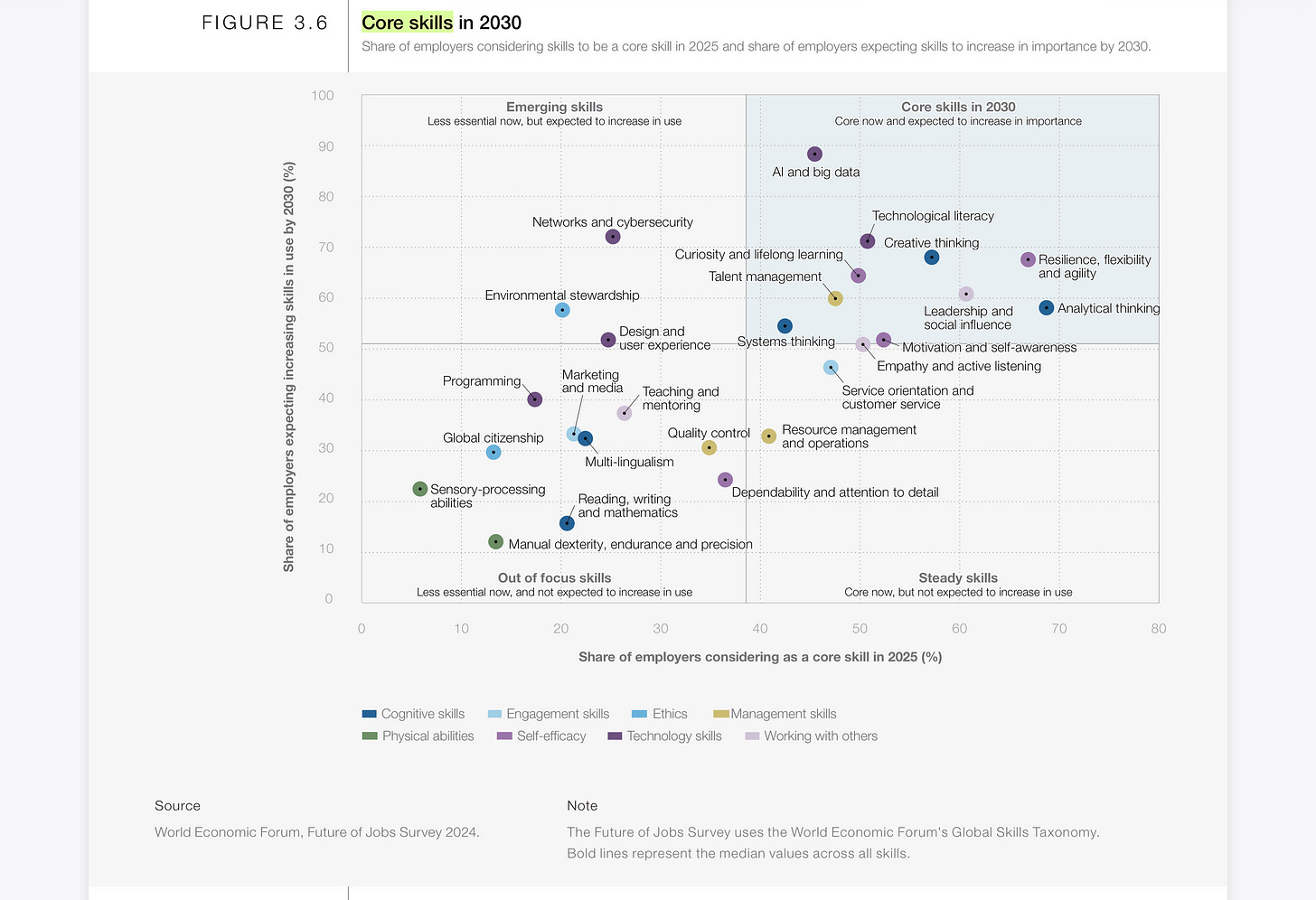

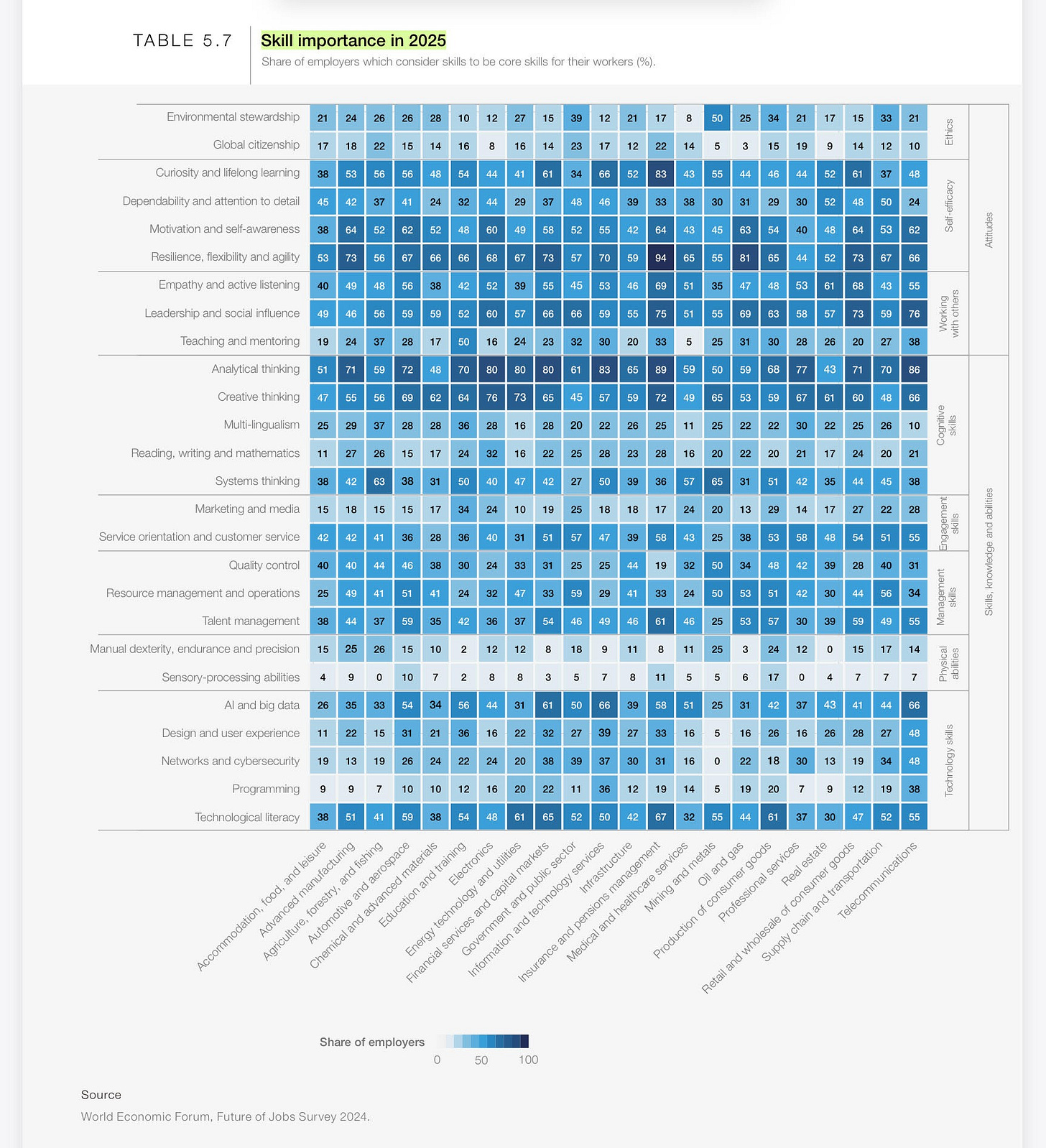

Core skills

critical role of adaptability and collaboration alongside cognitive skills

This combination of cognitive, self-efficacy and interpersonal skills

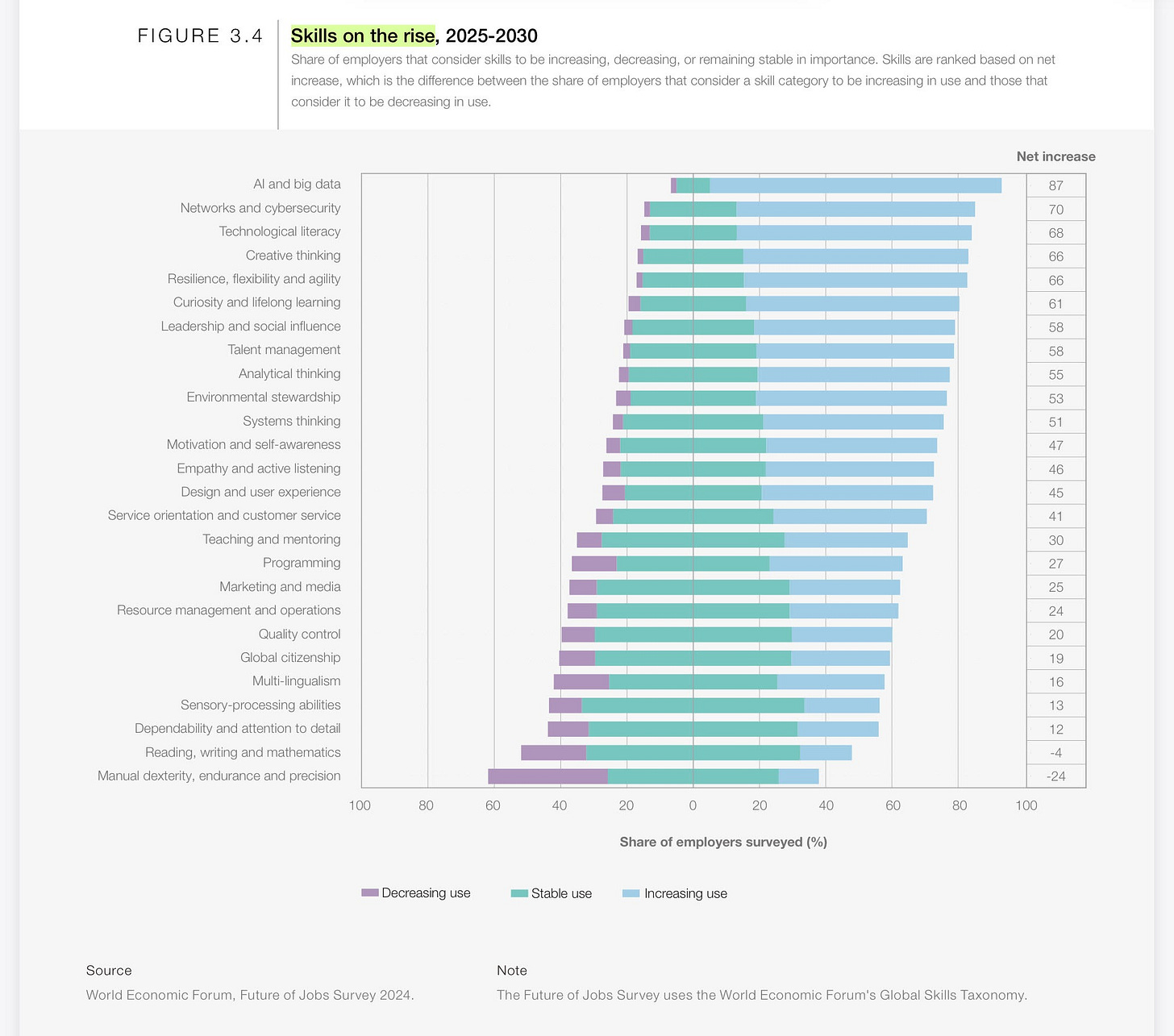

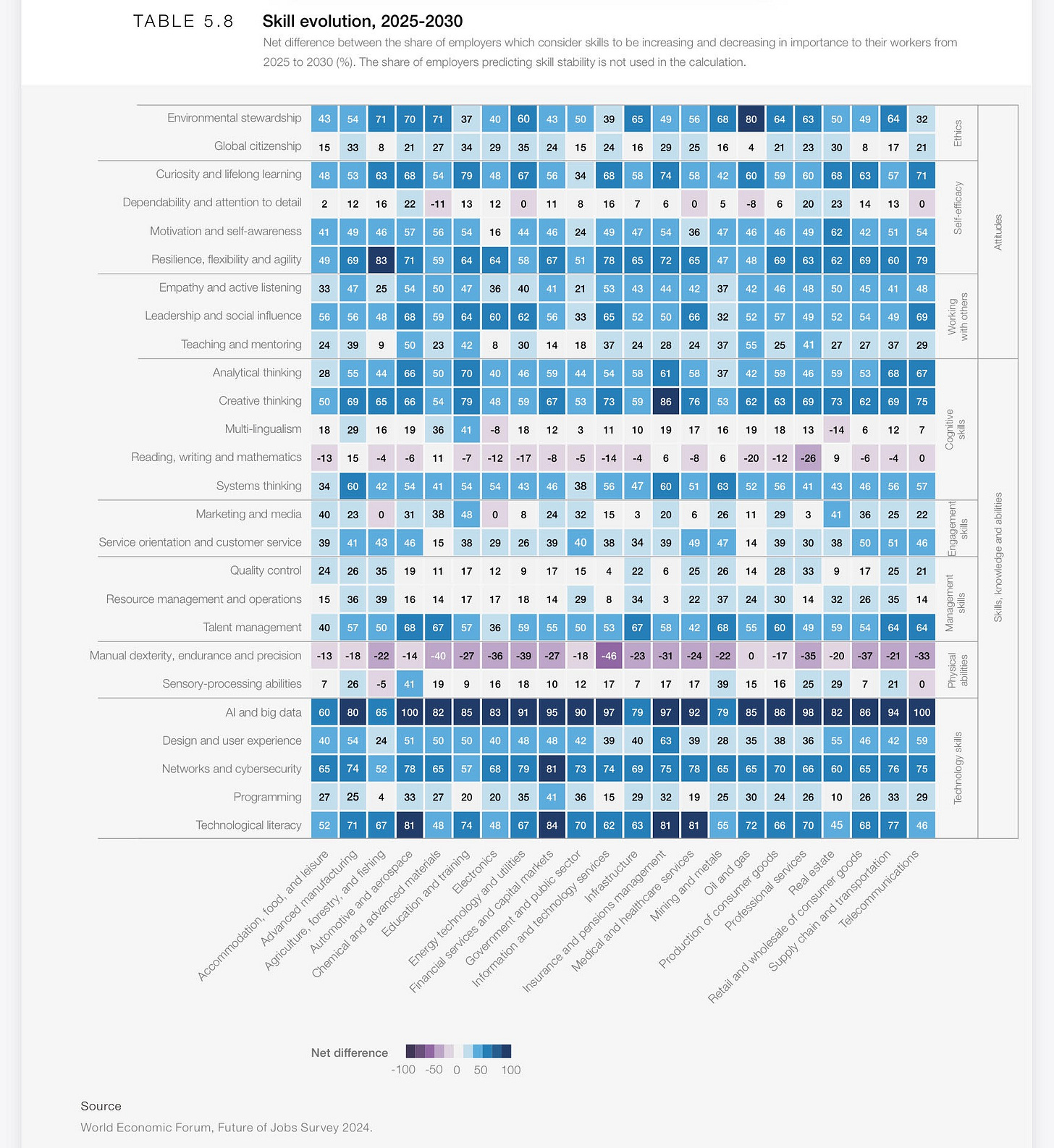

Skill evolution

AI and big data are predicted to see significant growth across nearly all sectors. In the top 10 industries, over 90% of respondents expect this skill to increase in use

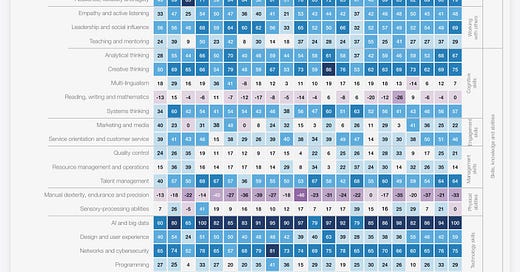

Skill differences between growing and declining jobs

While a diverse set of skills is essential for navigating the evolving workforce landscape, contrasting the skills requirements particularly associated with growing jobs, and those associated with declining ones, reveals windows of opportunity that exist for enabling dynamic job transitions

“importance gap”, which measures how much more essential a skill is for growing jobs, and the “proficiency gap”, which indicates the level of expertise required for each skill in growing jobs compared to declining jobs

Drivers of skill disruption: Technological change

Technological advances are expected to drive skills change more than any other trend over the next five years

Interestingly, whereas programming remains stable as an in-demand skill, both respondents expecting growth in its use and those expecting decline consistently point to technological change as the primary driver behind this change

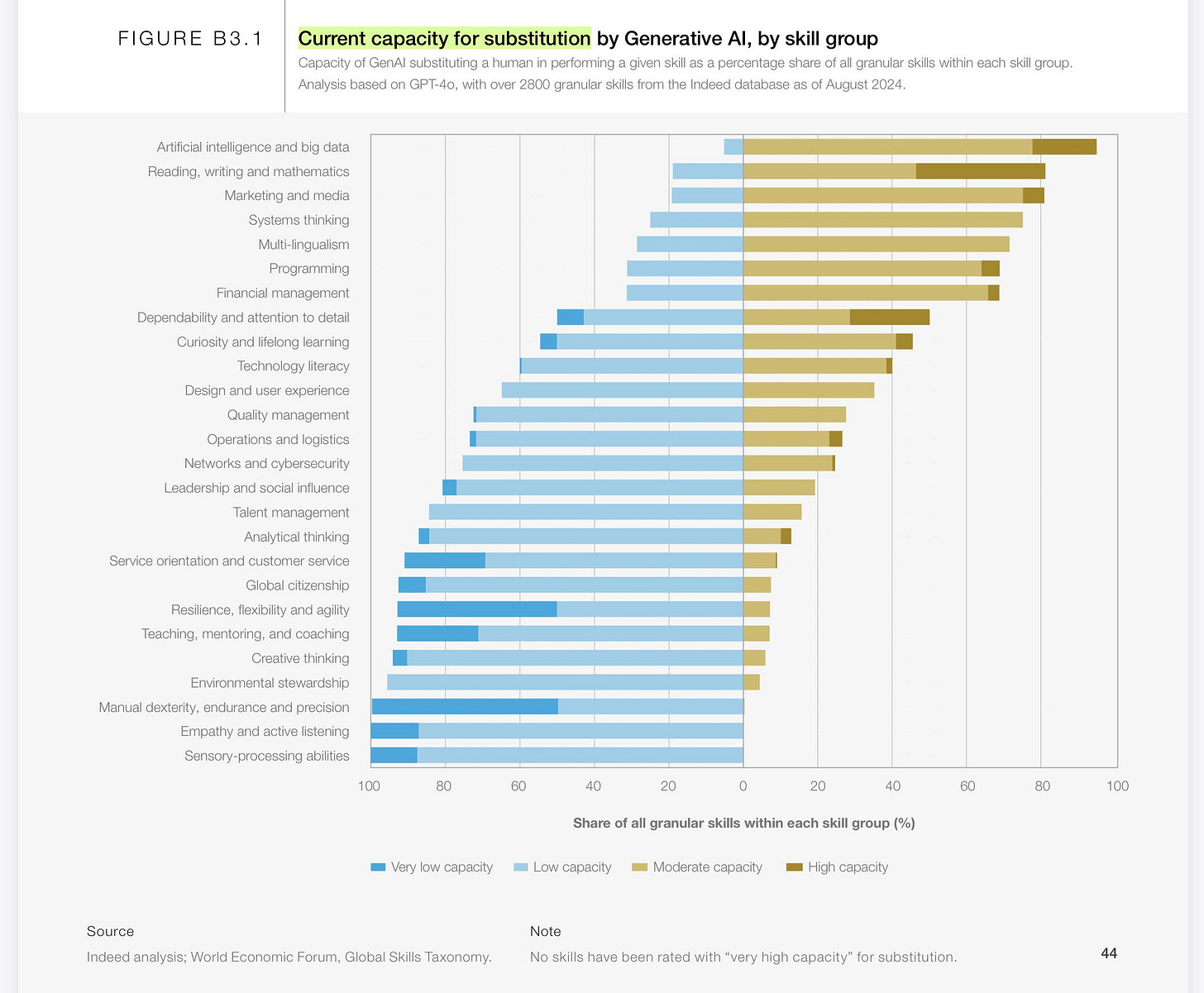

chart categorizes more than 2,800 granular skills into the World Economic Forum’s Global Skills Taxonomy and evaluates their capacity of substitution by GenAI according to five categories: very low capacity, low capacity, moderate capacity, high capacity, and very high capacity

more than one-quarter (28.5%) of the more than 2,800 granular skills examined currently exhibit a moderate capacity of substitution, highlighting areas where, as the technology continues to evolve, its capacity of substitution could increase in the near future

Skills requiring nuanced understanding, complex problem-solving or sensory processing show limited current risk of replacement by GenAI

Geoeconomic fragmentation and economic uncertainty

These geoeconomic trends have led to a surge in demand for network and cybersecurity skills as organizations seek to protect digital infrastructure from emerging threats.

In a world where crises are becoming more frequent, employers need leaders and teams capable of adapting to uncertainty and managing complex social dynamics.

Slower economic growth and increased restrictions to global trade are contributing to the increased importance of creative thinking and resilience, flexibility, and agility. These skills are crucial for navigating uncertain economic landscapes, as businesses seek to innovate and remain competitive despite market constraints.

Demographic shifts

Aging and declining working-age populations are pressing organizations to prioritize talent management, teaching and mentoring and motivation and self-awareness

These trends reveal the dual role demographic changes play in shaping both job availability and the types of skills needed, emphasizing the interconnectedness of workforce demographics with skills development and talent strategies across sectors

Reskilling and upskilling strategies

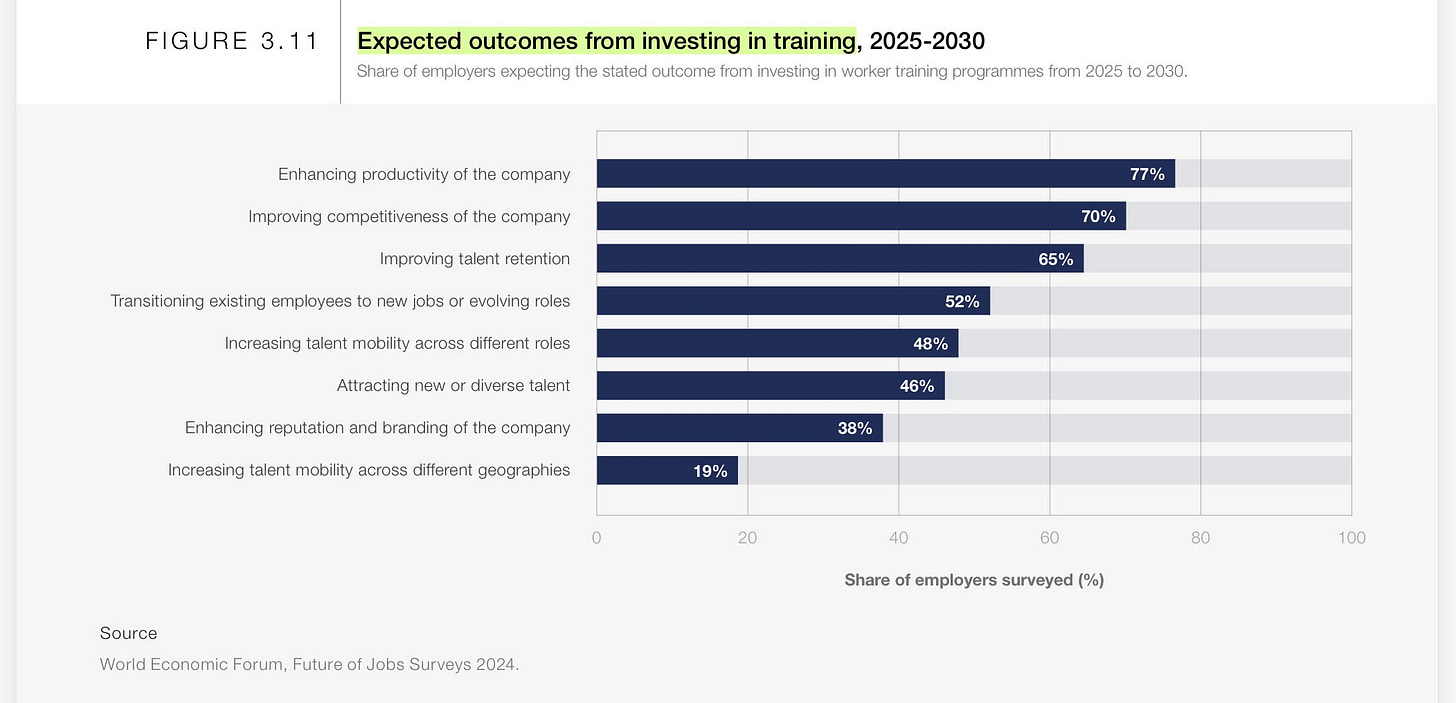

training trends, how employers expect to finance their training initiatives, and their expectations regarding the outcomes of these investments

free of cost training

4. Workforce strategies

Barriers to transformation

industry attractiveness and firm-level attractiveness

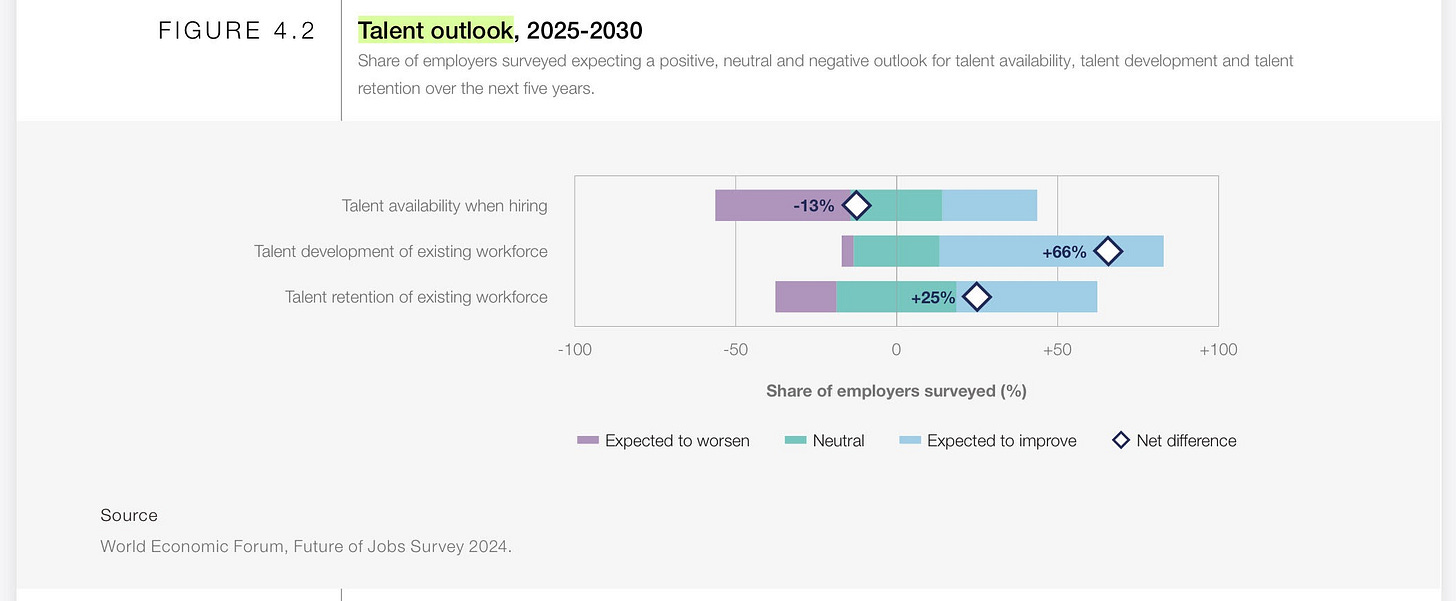

Talent availability outlook

employers in European economies anticipate increasing challenges in hiring availability

Workforce strategy

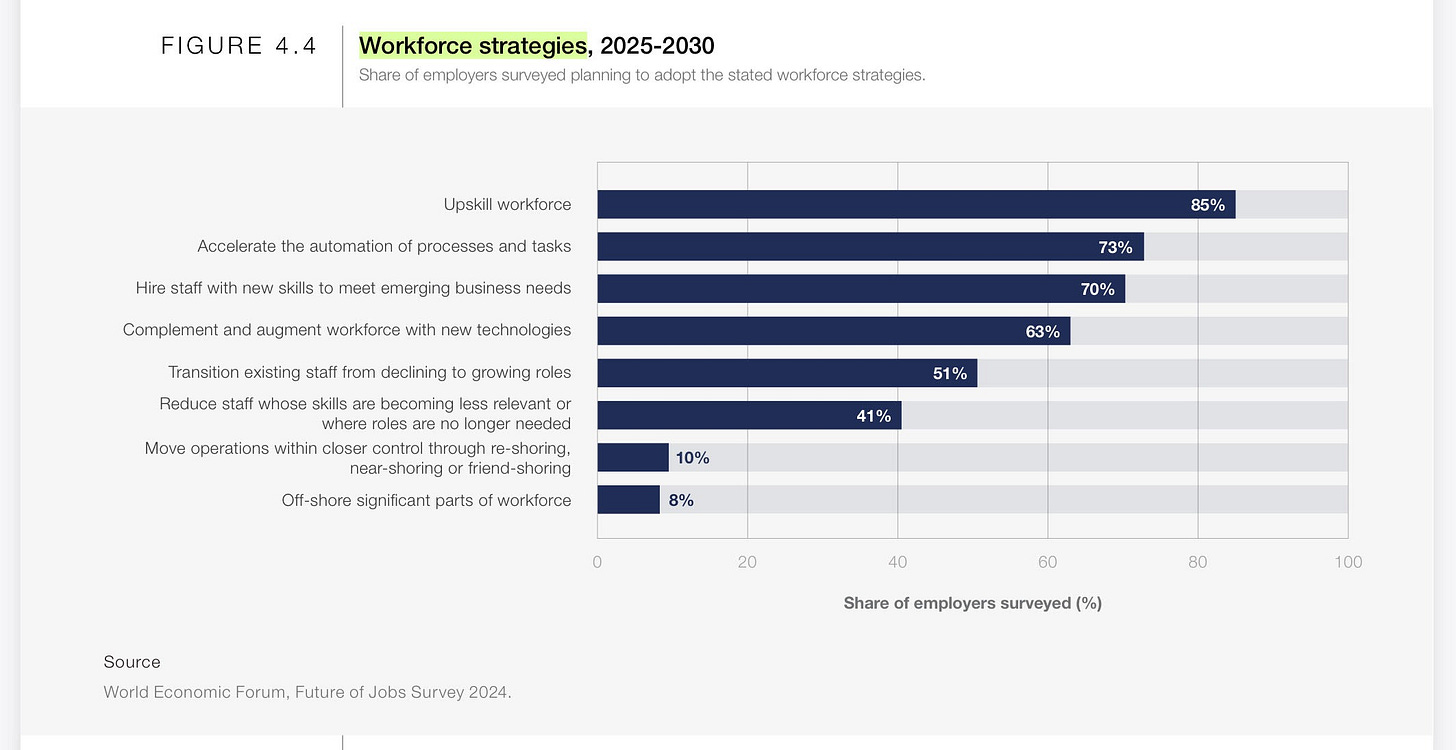

Upskilling is identified as a top 3 priority across all geographies

Process and task automation is expected to be the second most common workforce strategy

Automation is a more pronounced strategy in high-income economies (77%), compared to upper-middle-income (74%) and lower-middle income economies (57%).

Regarding adjusting the composition of their workforce, 70% of organizations surveyed plan to hire new staff with emerging in-demand skills, 51% intend to transition staff from declining to growing roles internally, while 41% foresee staff reductions due to skills obsolescence.

A slightly higher share of employers plan to move operations within closer control through reshoring, nearshoring or friendshoring (10%) than those who plan to offshore significant parts of their workforce (8%).

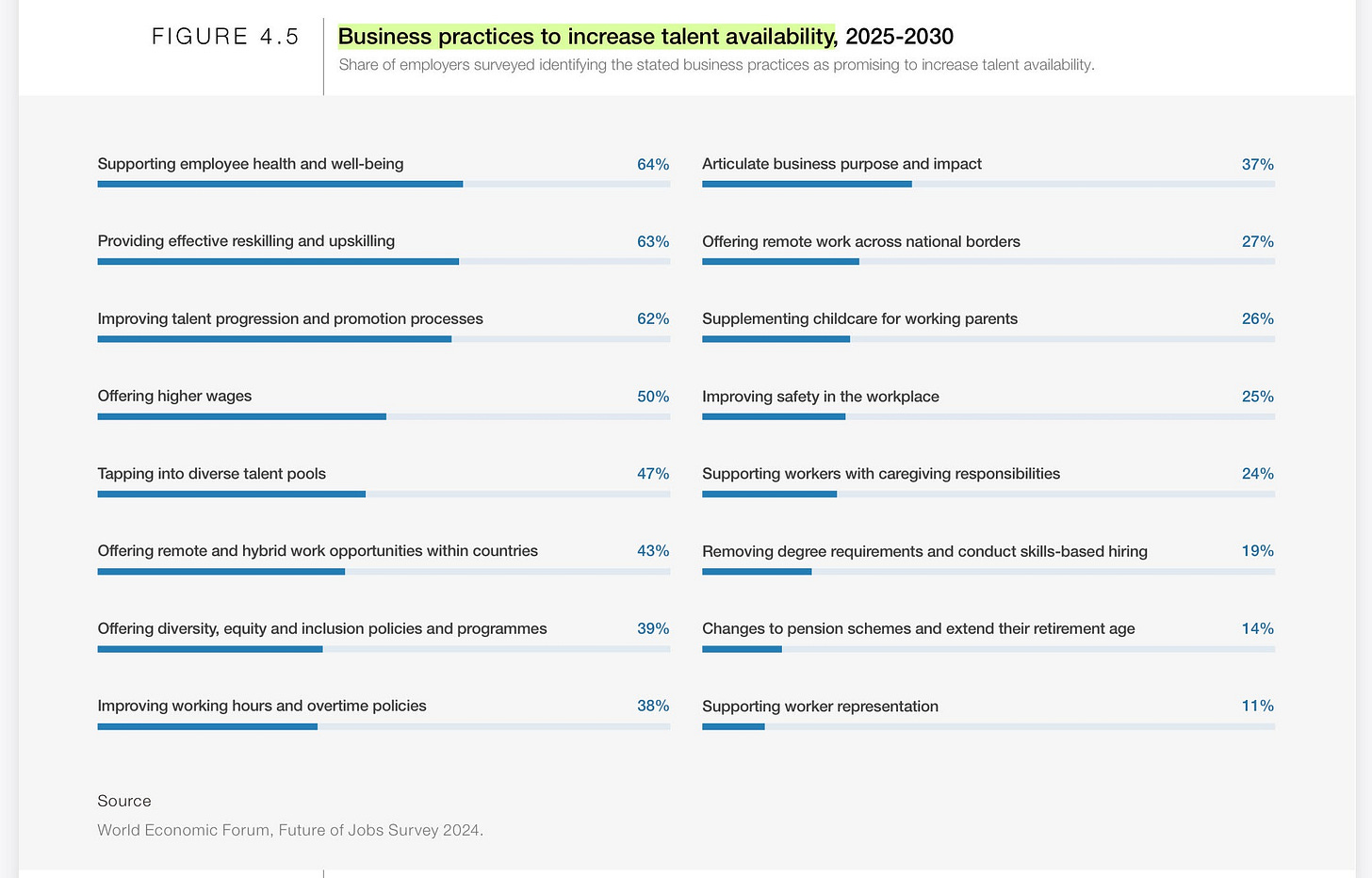

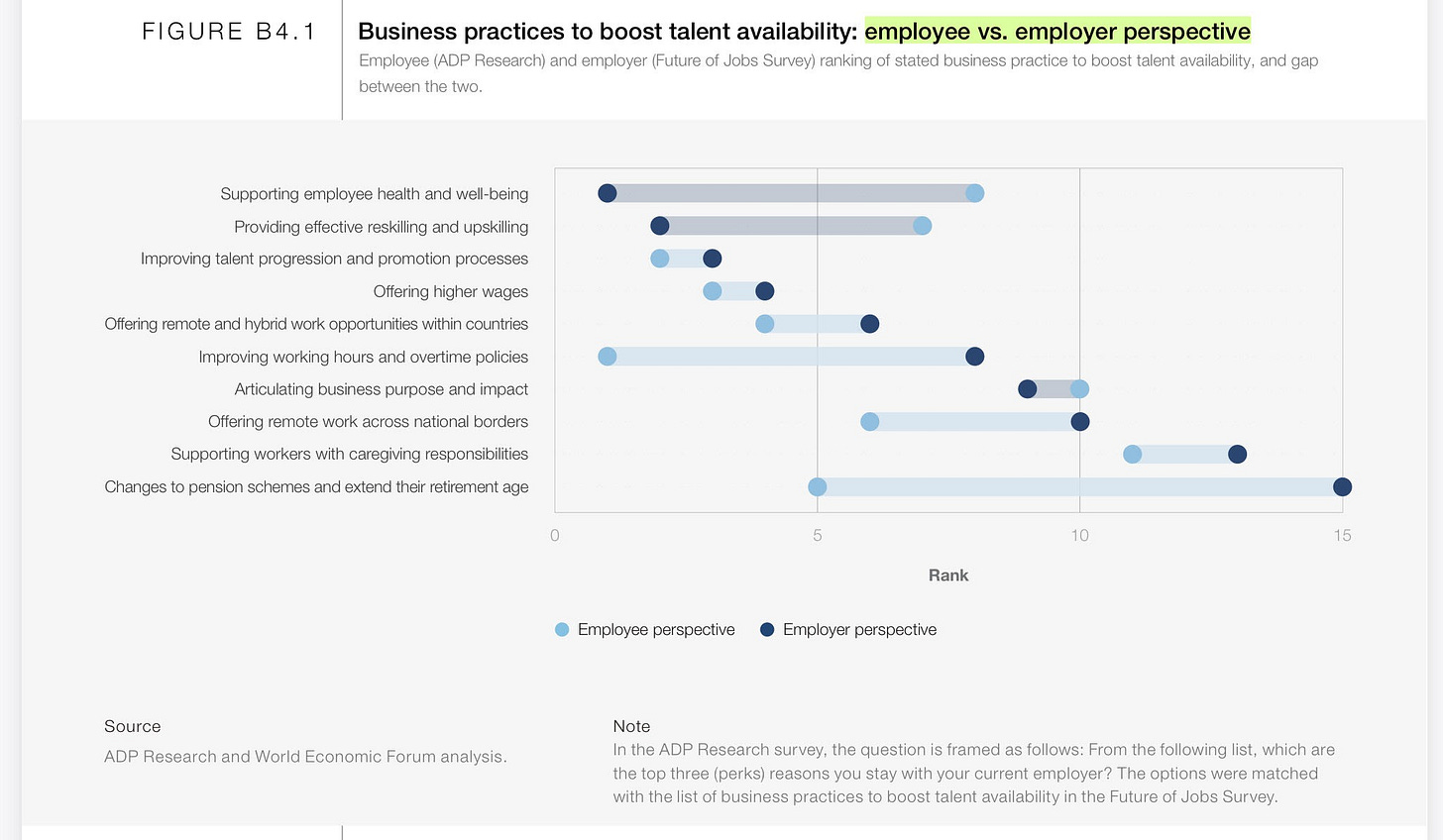

Improving talent availability

Public policies

businesses’ desire for sustained public investment in skills development to align workforce capabilities with future labour-market demands

Workforce strategies in response to AI adoption

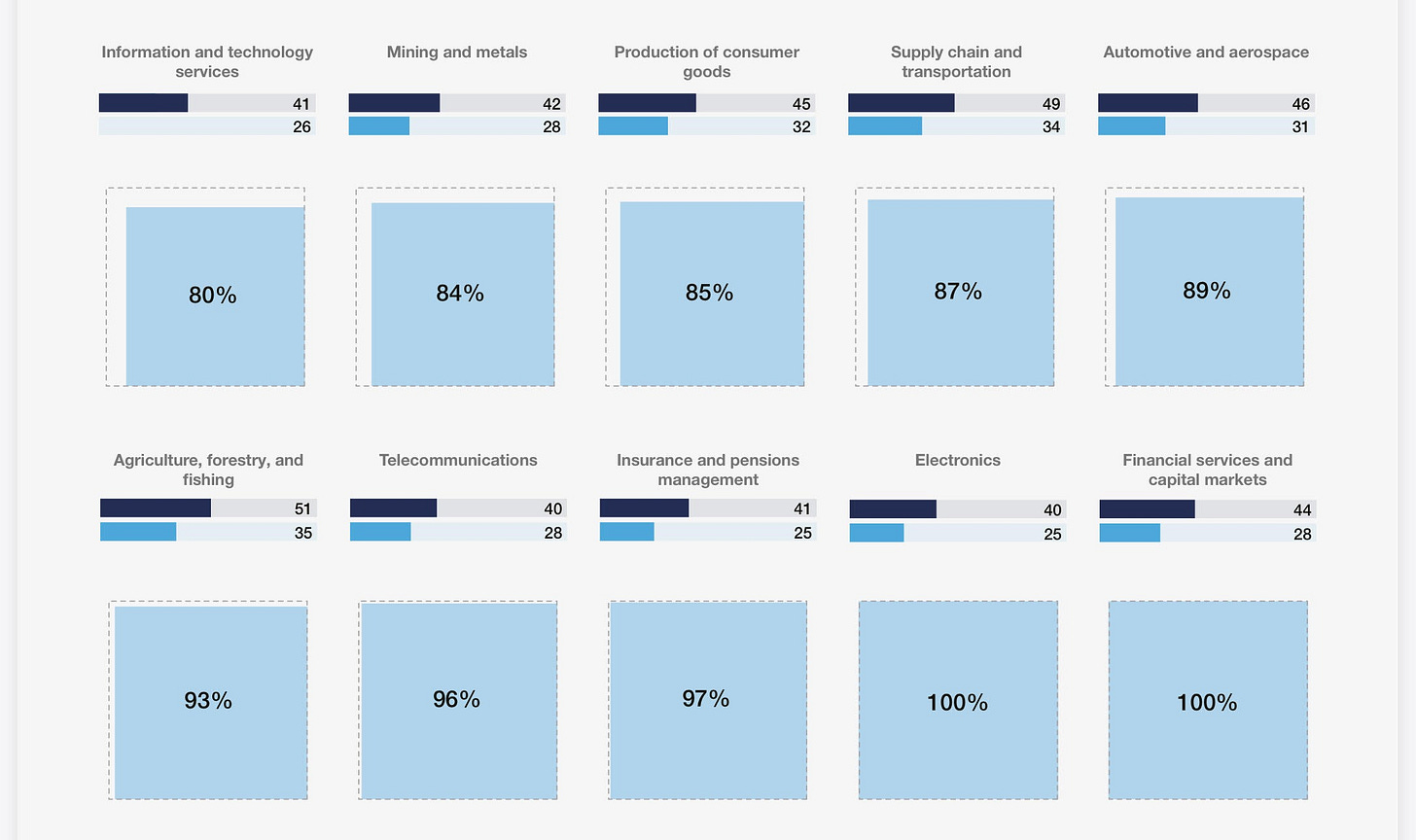

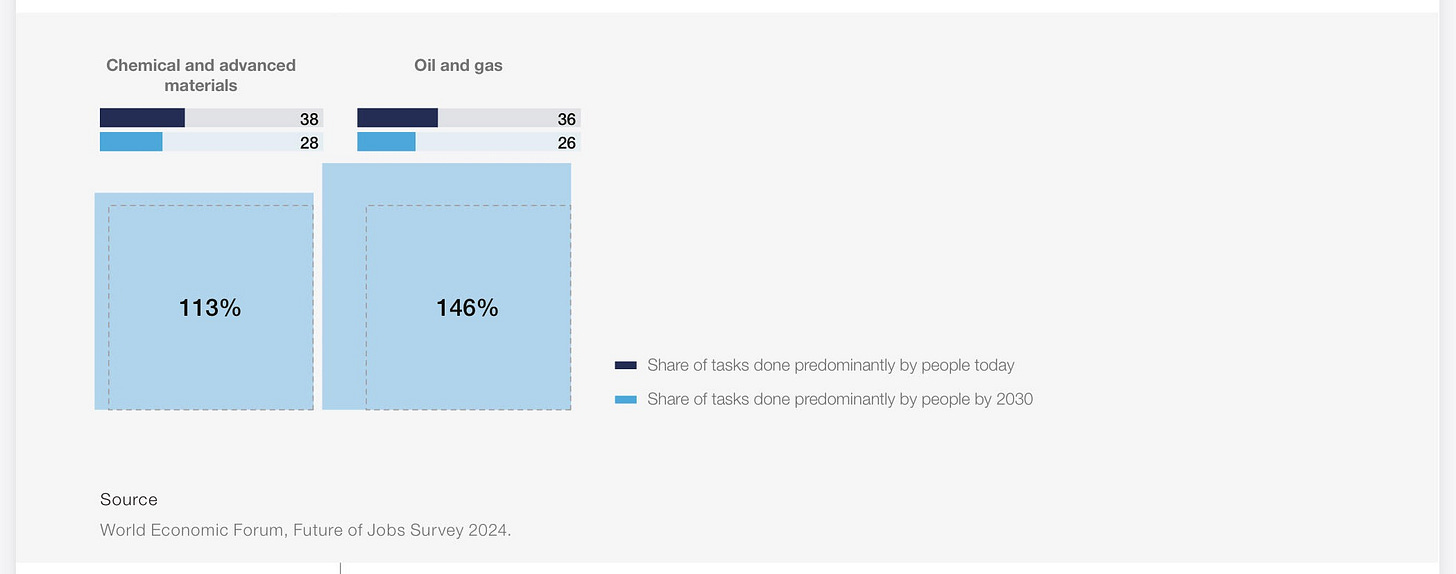

86% of employers expect AI and information processing technologies to transform their business by 2030.

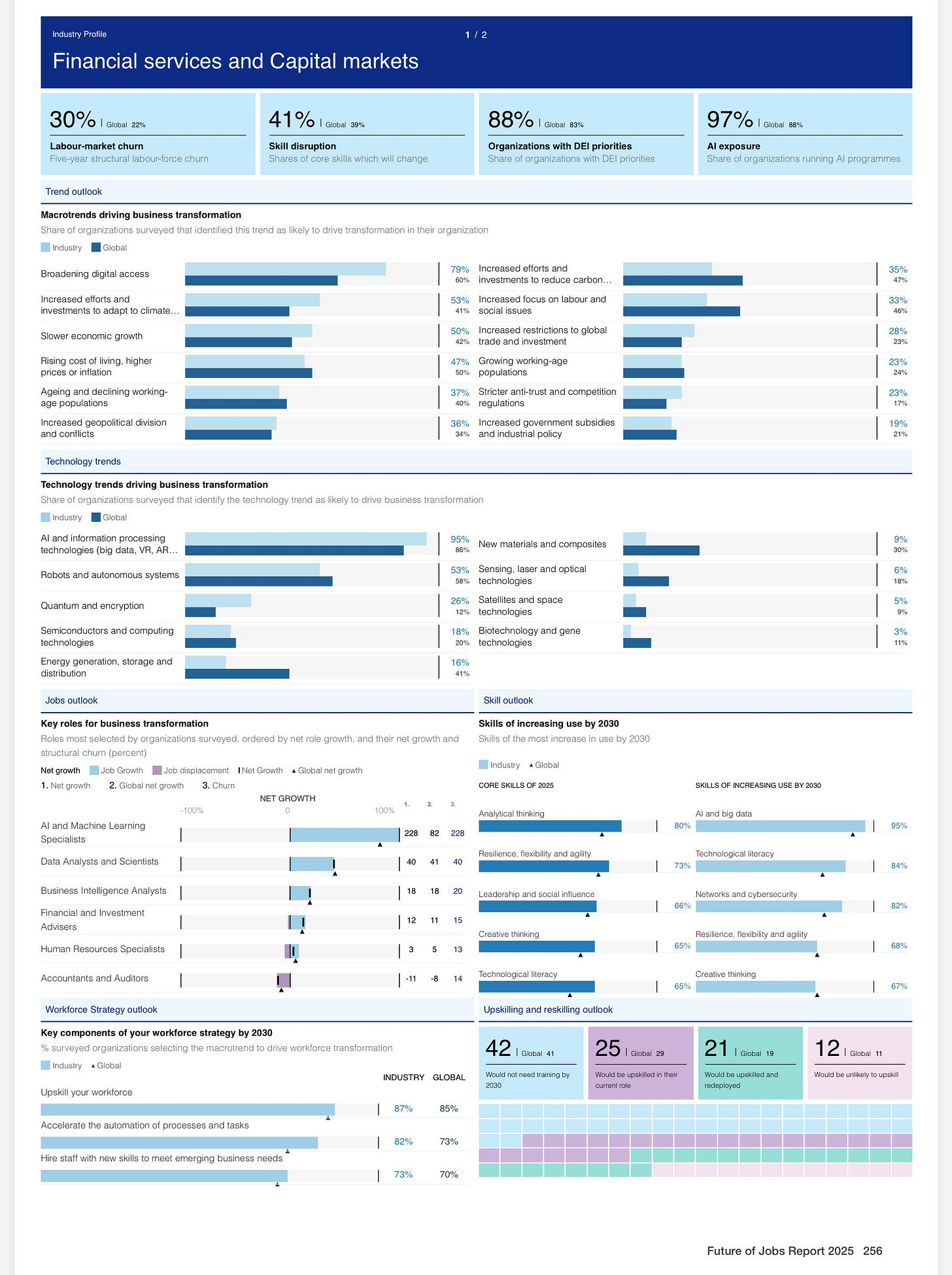

In the Financial Services (97%) and Electronics (95%) sectors, anticipated AI exposure is notably higher than the global average

Larger organizations are considering it more likely that their business model will be transformed by AI: only 6% of companies with over 50,000 employees expect low AI exposure by 2030, compared to 16% of companies with fewer than 1,000 employees and 15% of those with 1,000-5,000 employees.

Almost half of organizations are expecting to reorient their business models toward new AI-driven opportunities (49%), while 47% plan to transition employees from AI-disrupted roles to other positions.

While most employers plan to hire new people with AI relevant skills, a significant share (41%) also expect to downsize their workforce as AI

capabilities to replicate roles expand.

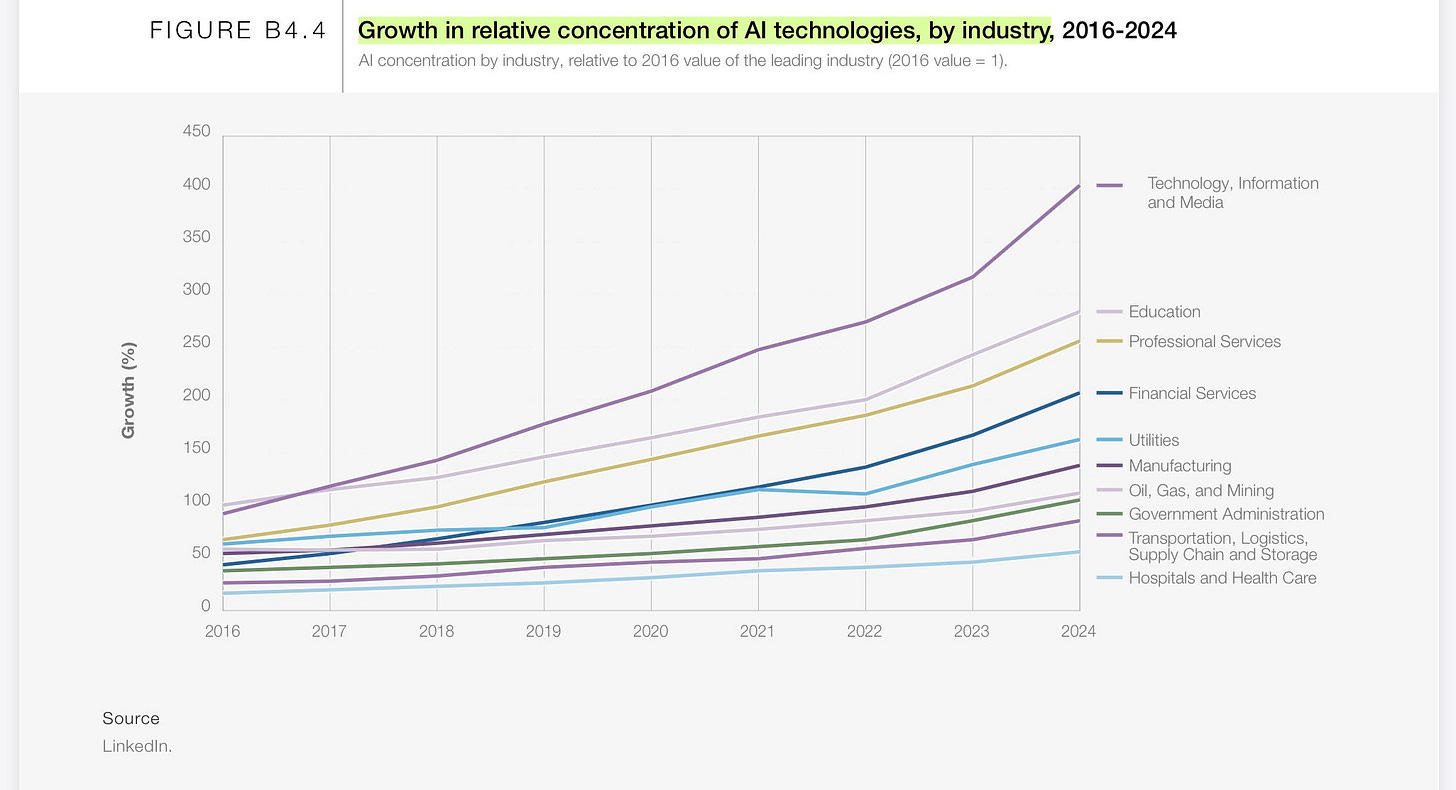

Relative AI job and skill concentration, by industry

This analysis helps illustrate which industries have seen the greatest AI uptake, in terms of AI-related jobs and skills as well as AI concentration trends over time.

5. Region, economy and industry insights

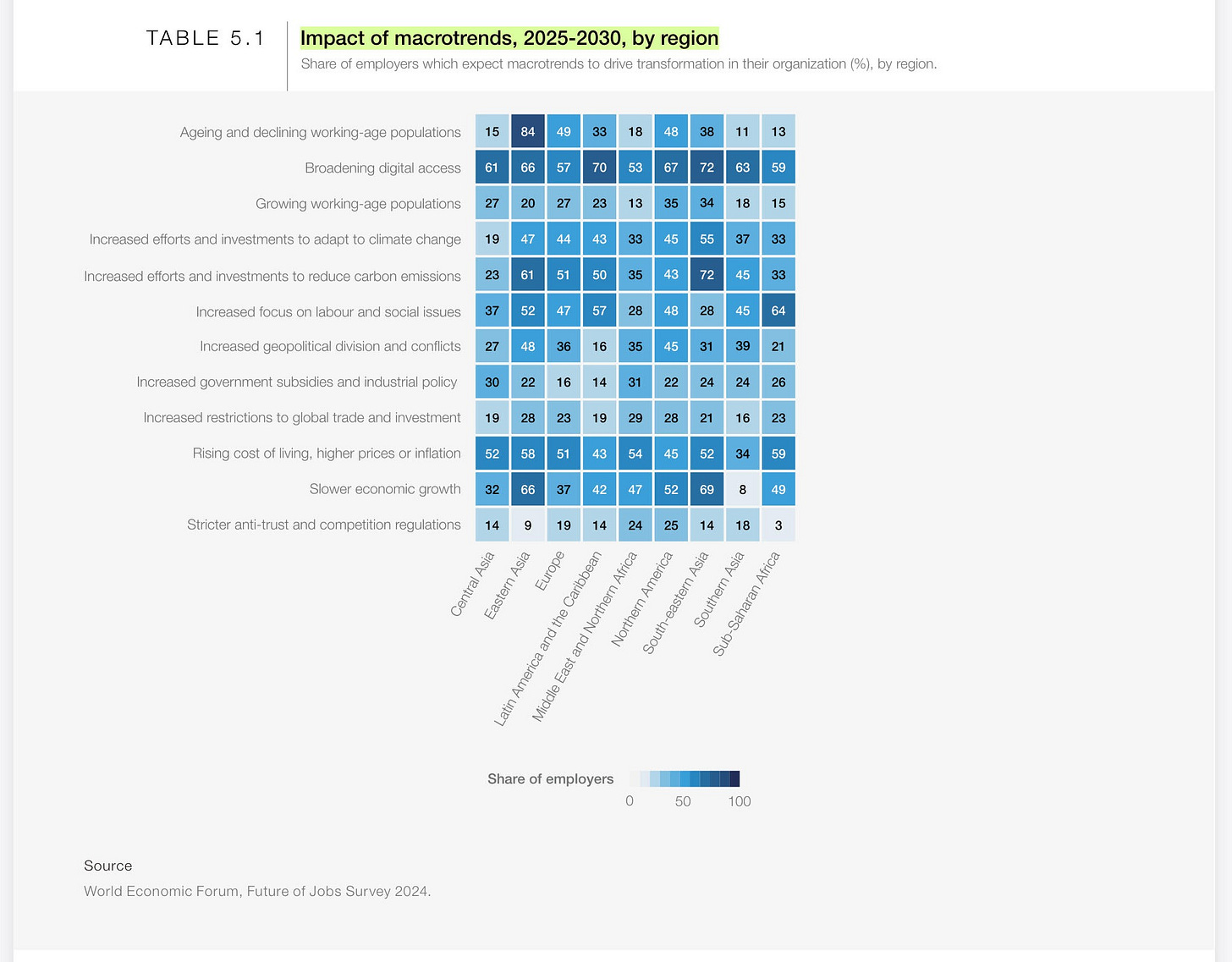

Impact of macrotrends by region

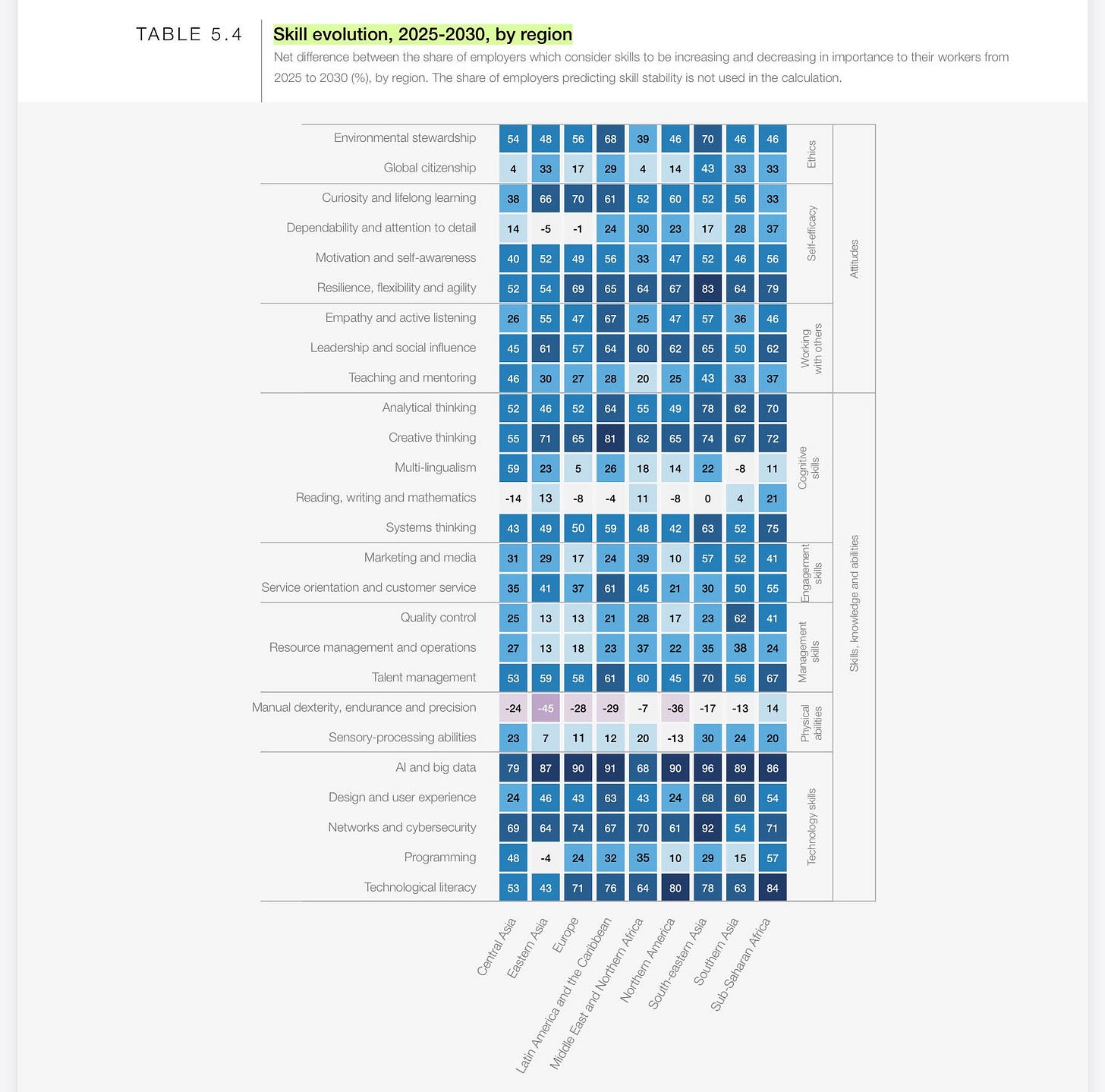

Skill importance by region

Skill evolution by region

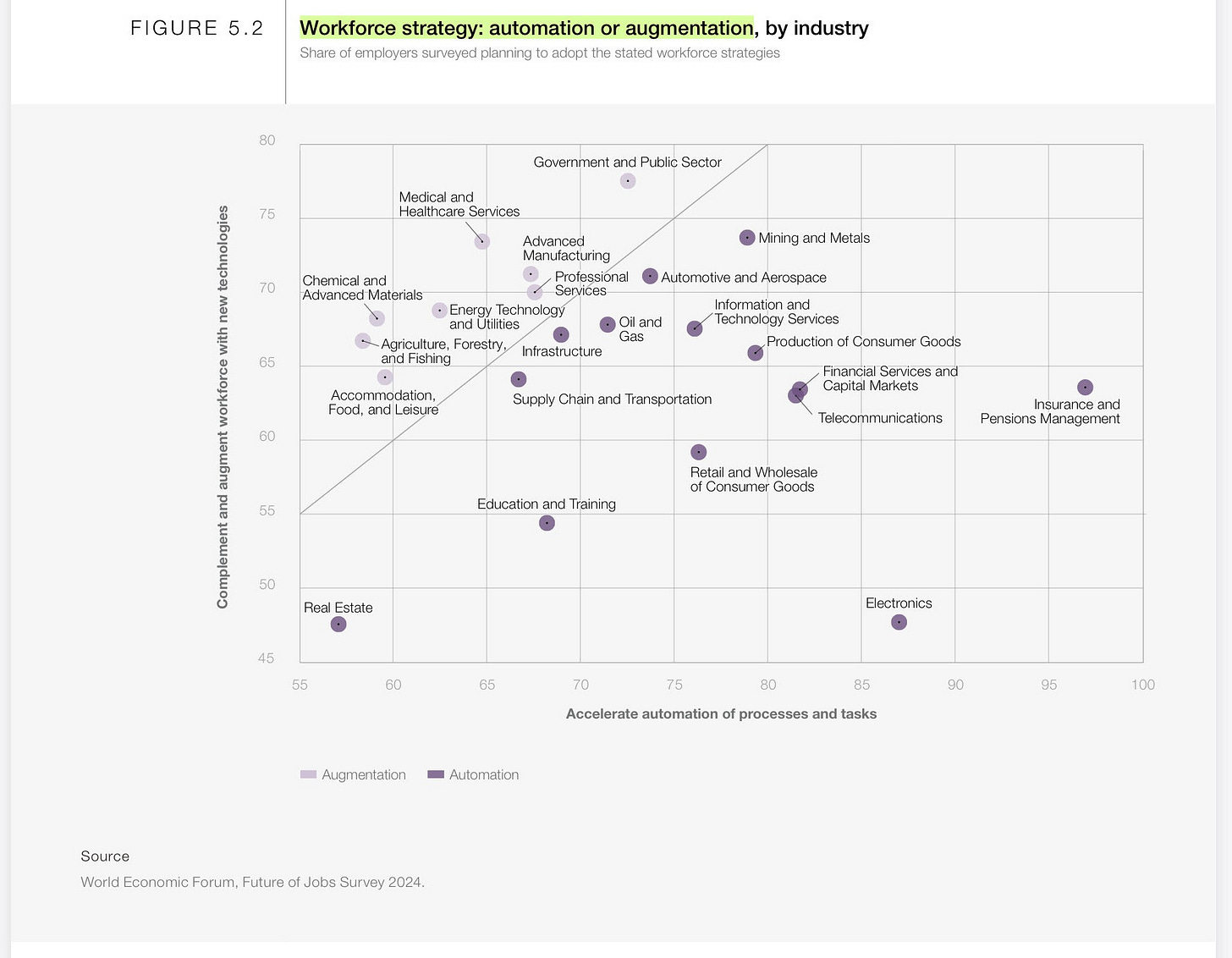

Workforce strategy by industry

Impact of macrotrends by industry

Impact of tech trends by industry

Skill importance by industry

Skill evolution by industry

Conclusions

evermore complex environment for policy-makers, employers and workers to navigate, and uncertainty remains high

strongly net-positive global employment outlook

early signals of likely future priority areas for constructive multistakeholder engagement

need for proactive and dynamic job transitions

questions concerning appropriate future balance between

deeper automation and broader augmentation

building of a future-ready workforce

Economy Profiles

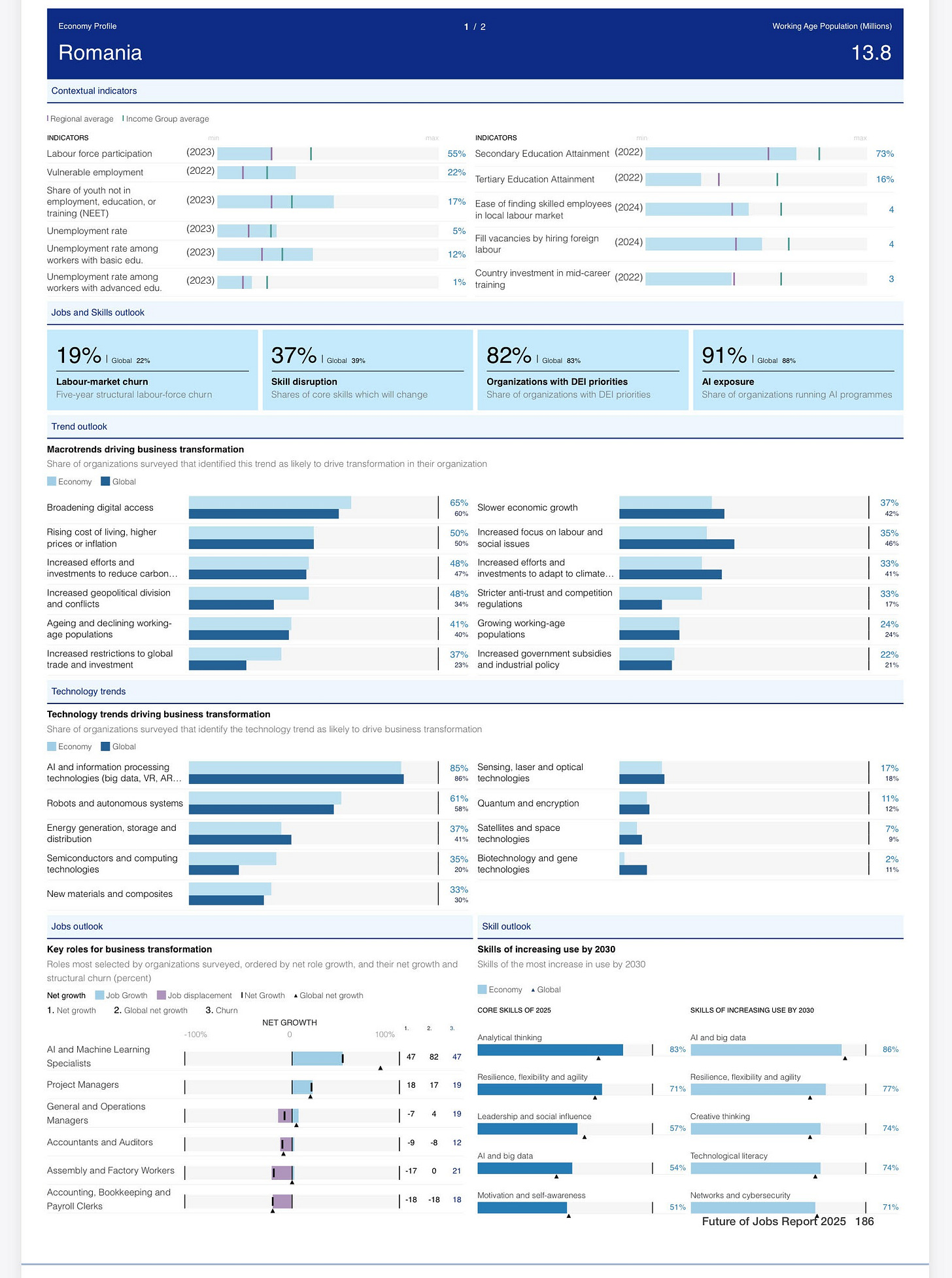

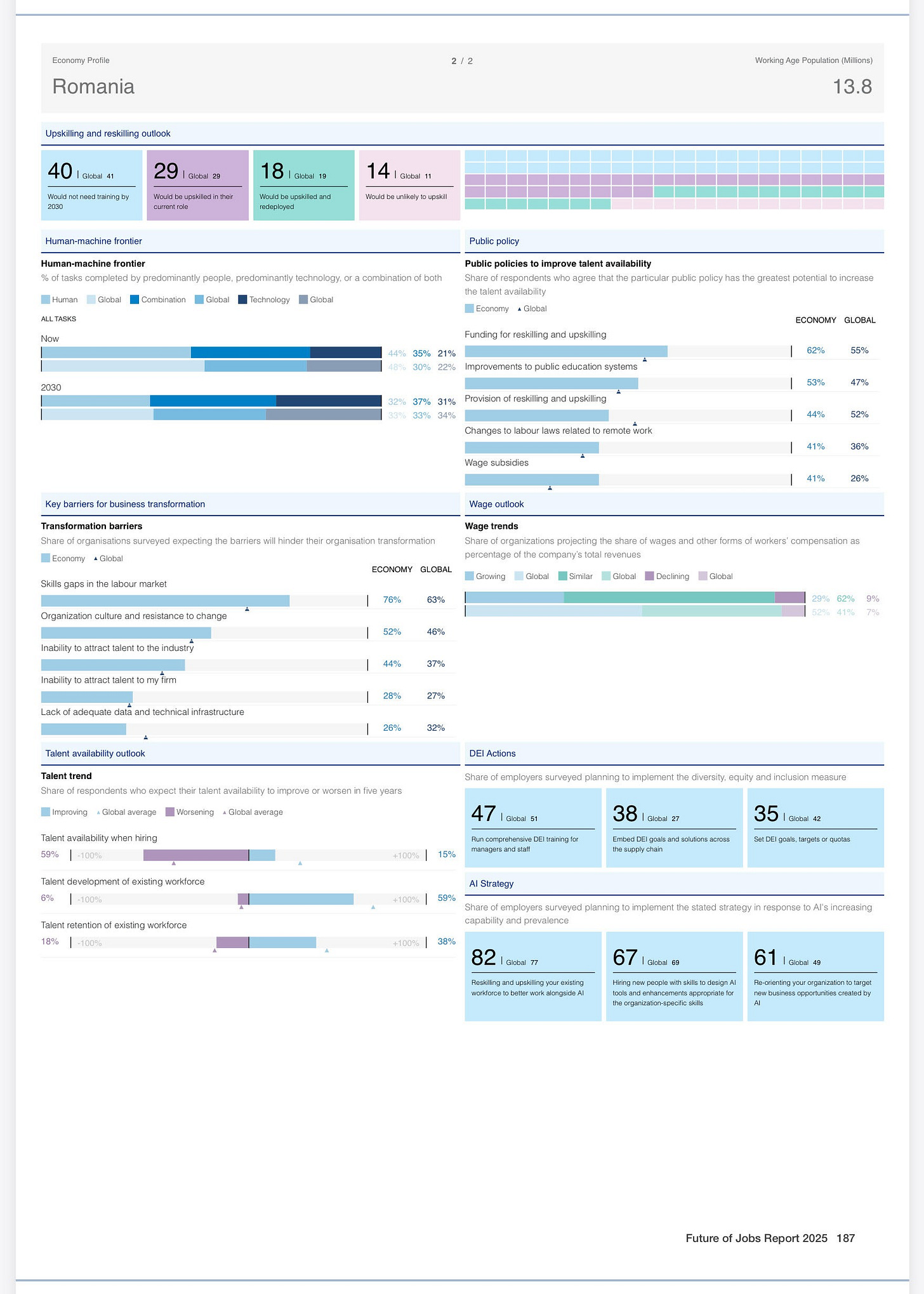

Romania

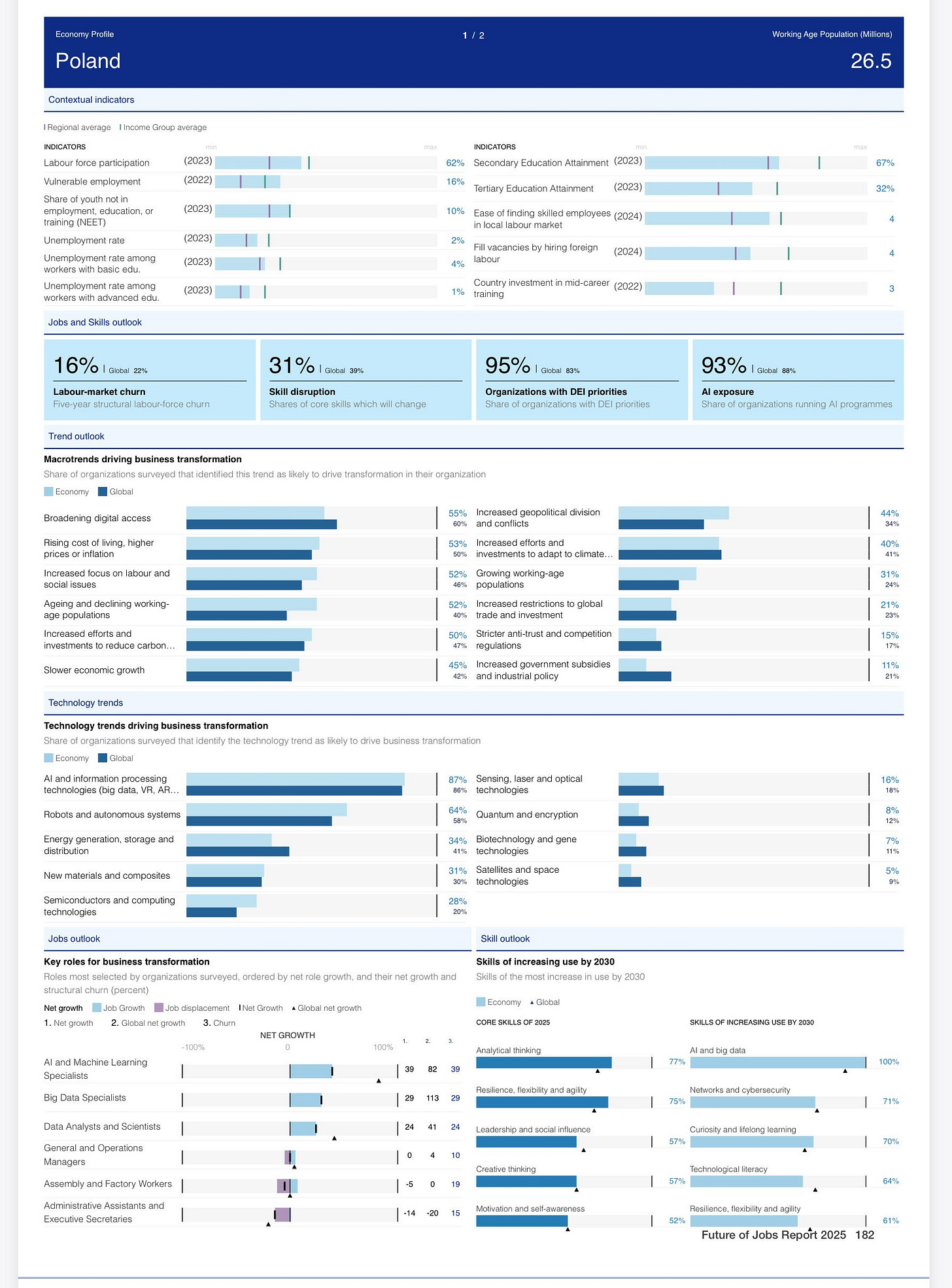

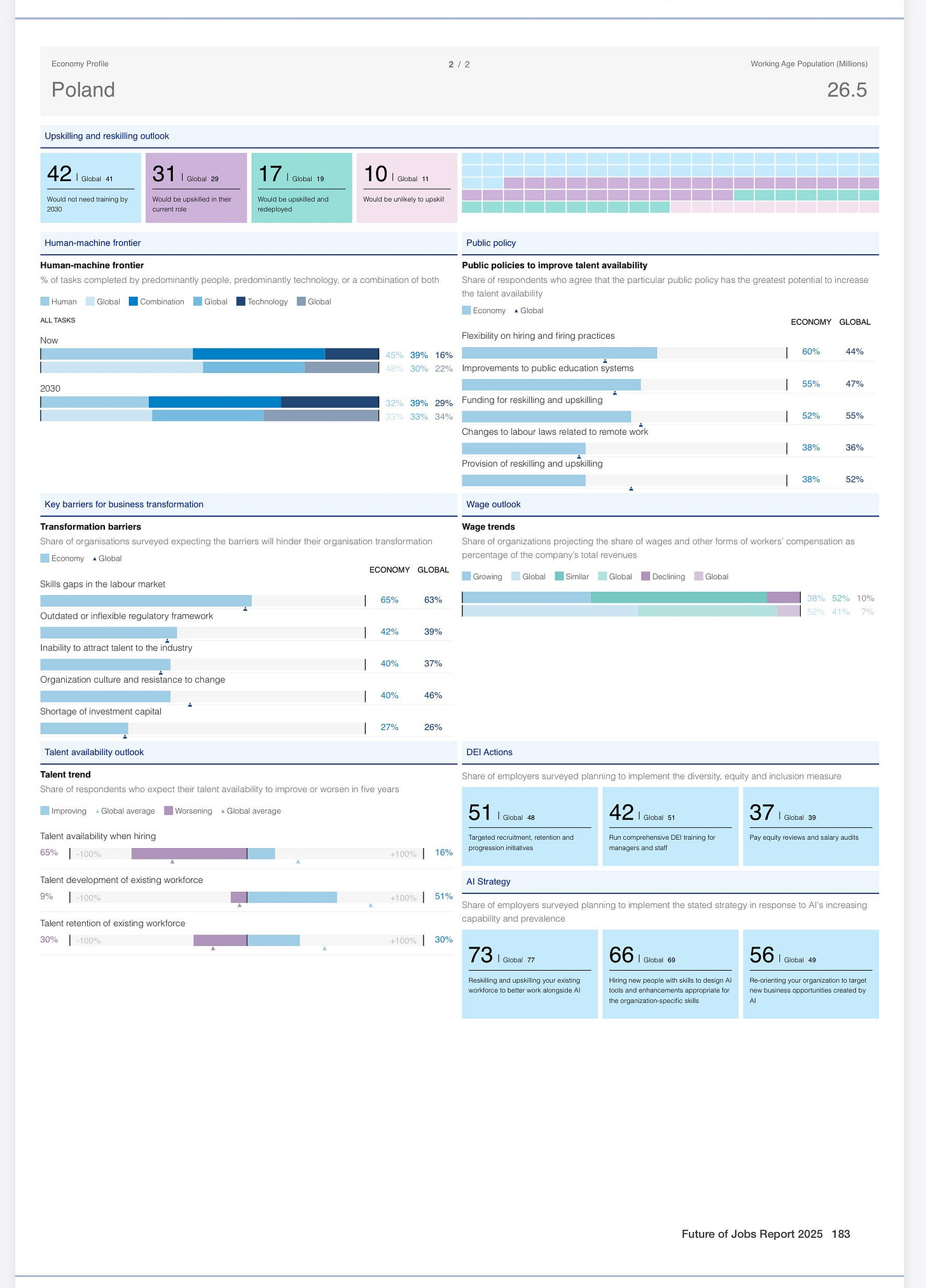

Poland

Industry Profiles

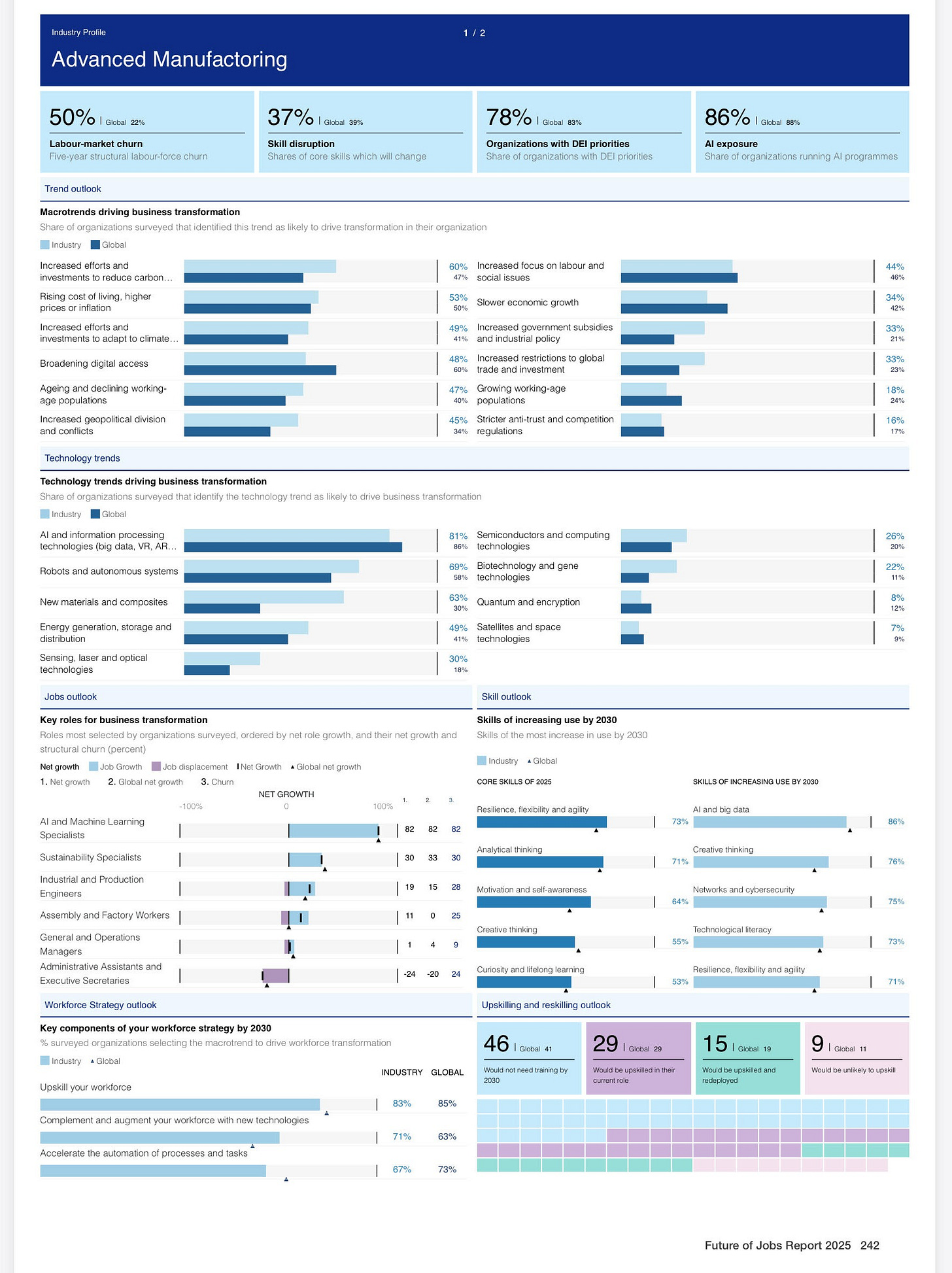

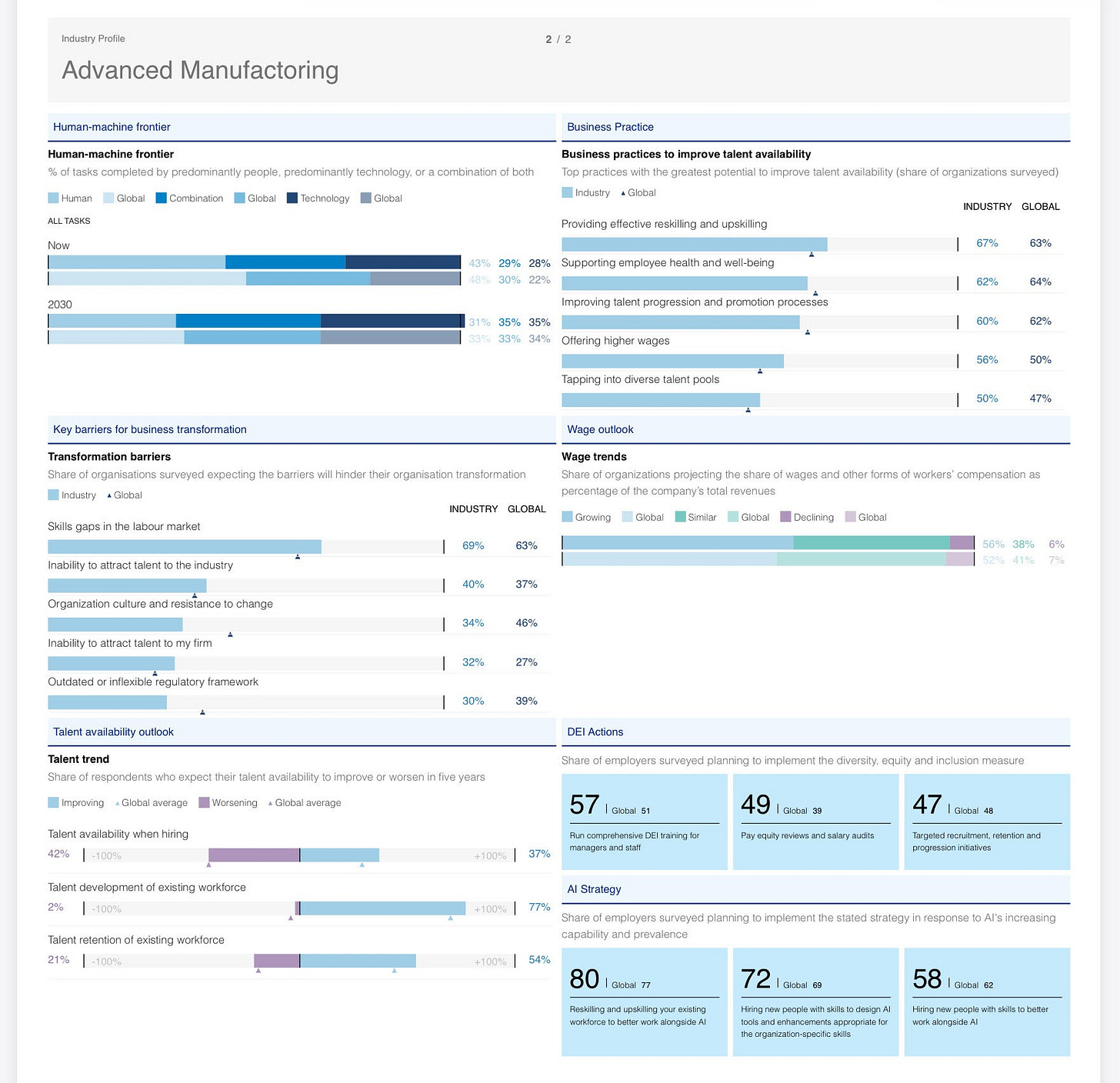

Advanced Manufacturing

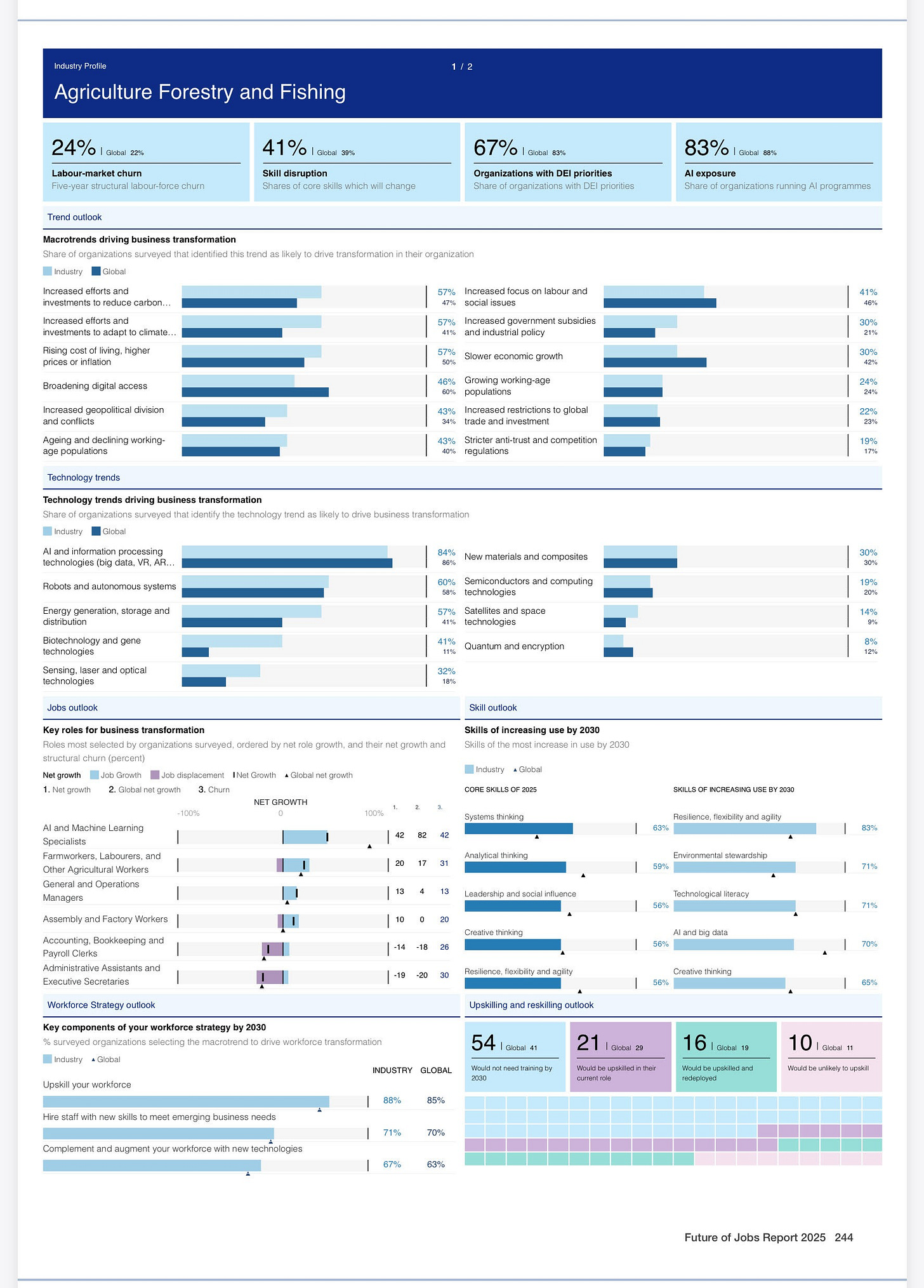

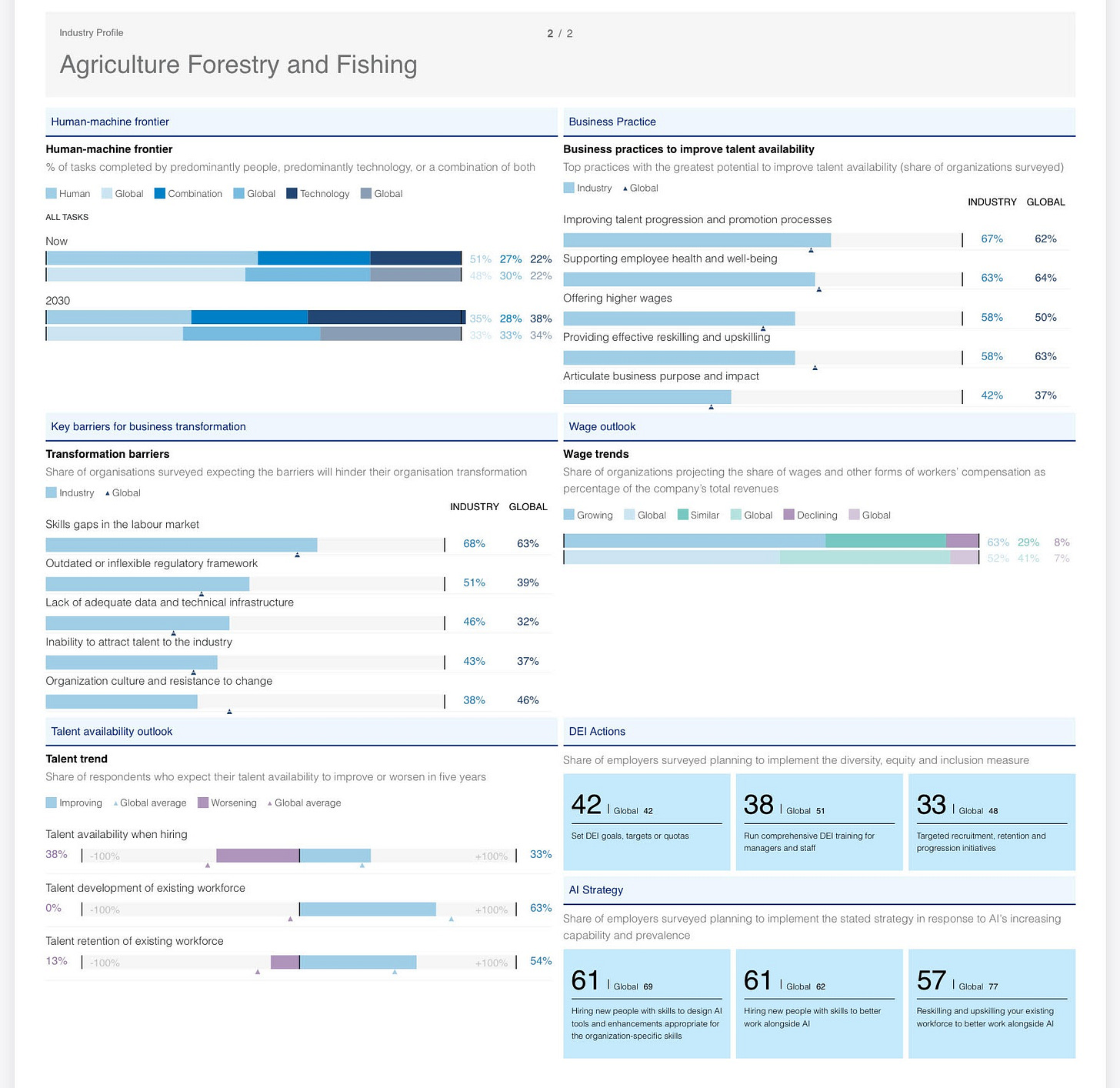

Agriculture, Forestry and Fishing

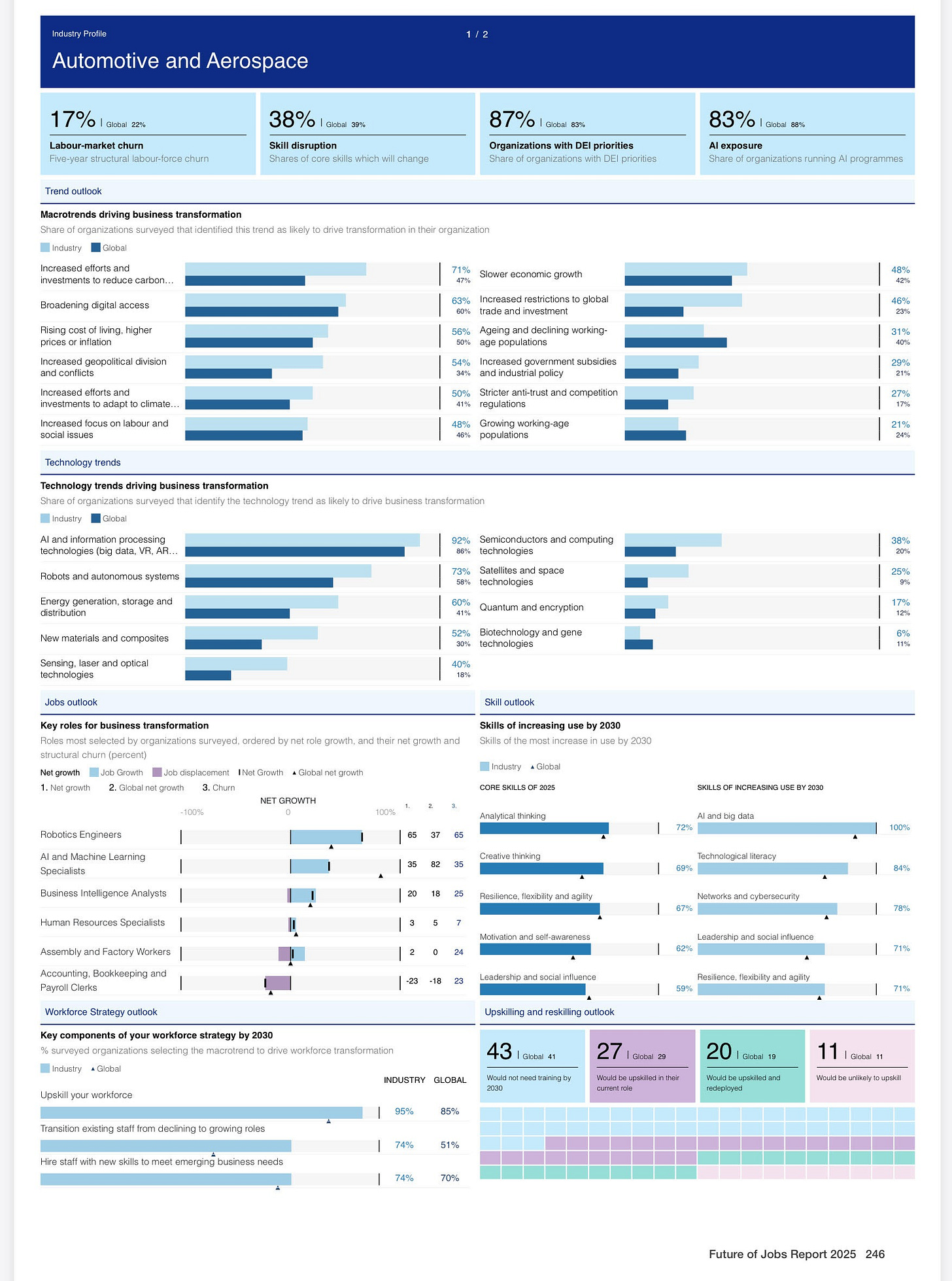

Automotive and Aerospace

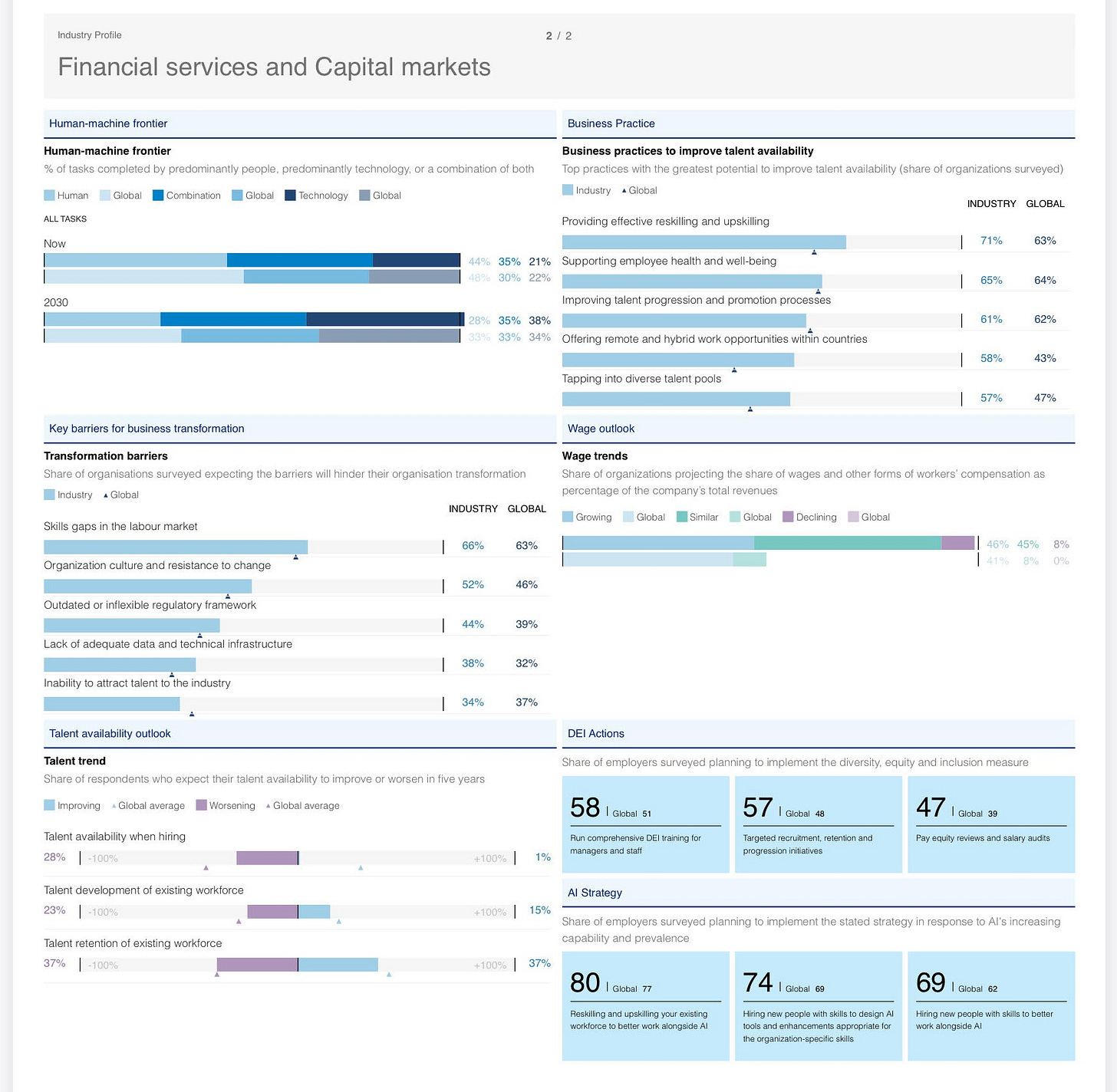

Financial Services and Capital Markets

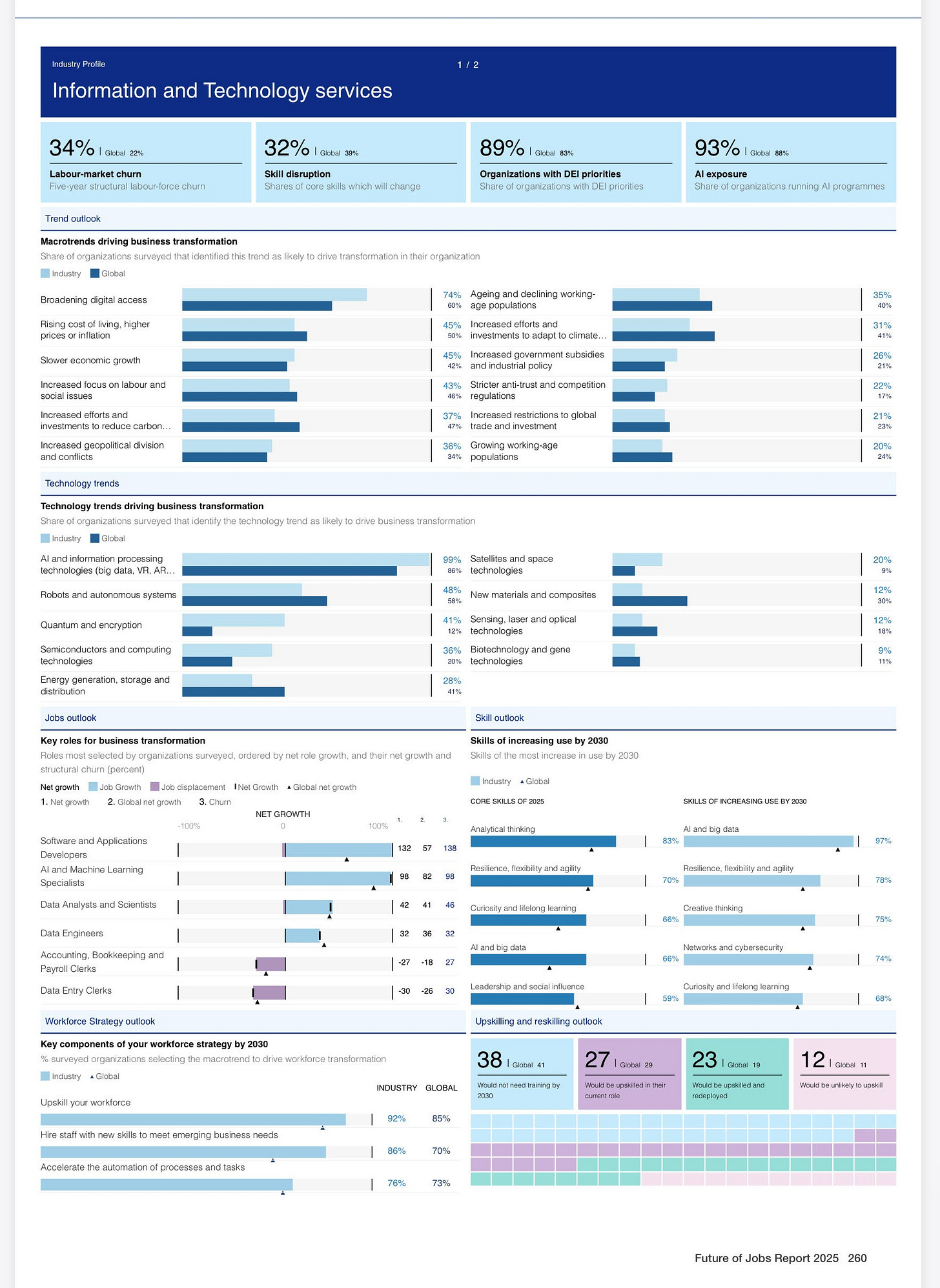

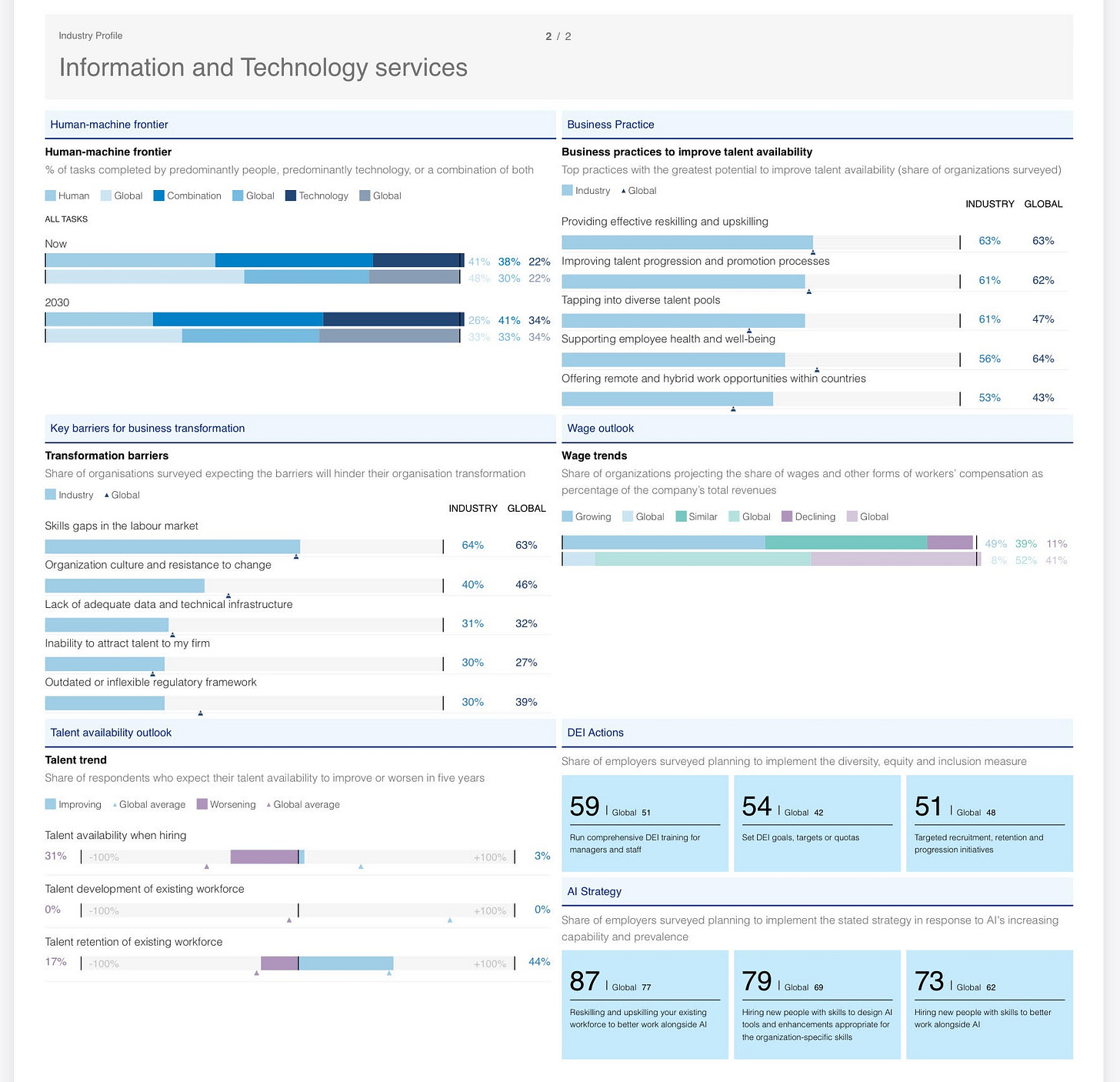

Information and Technology Services

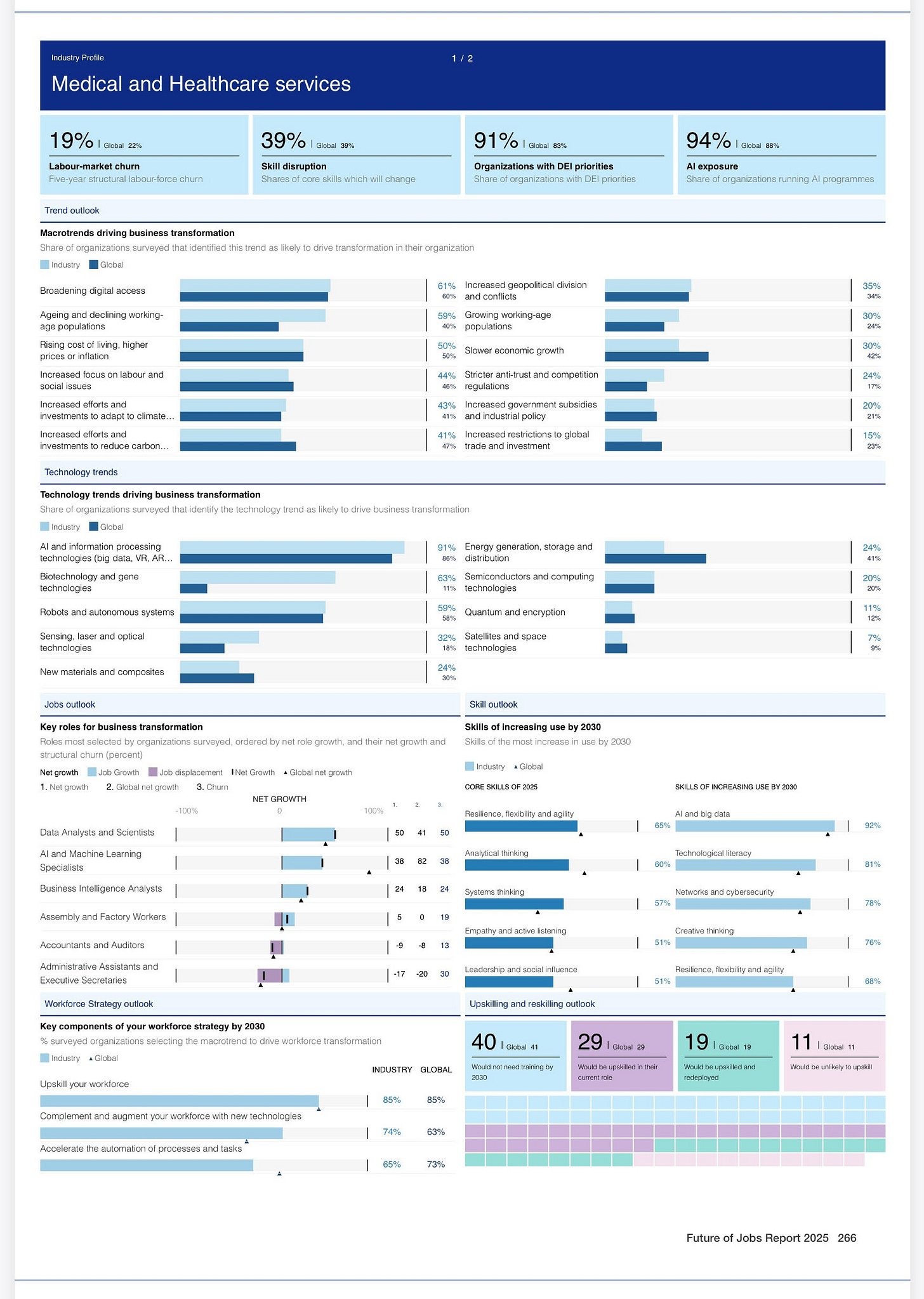

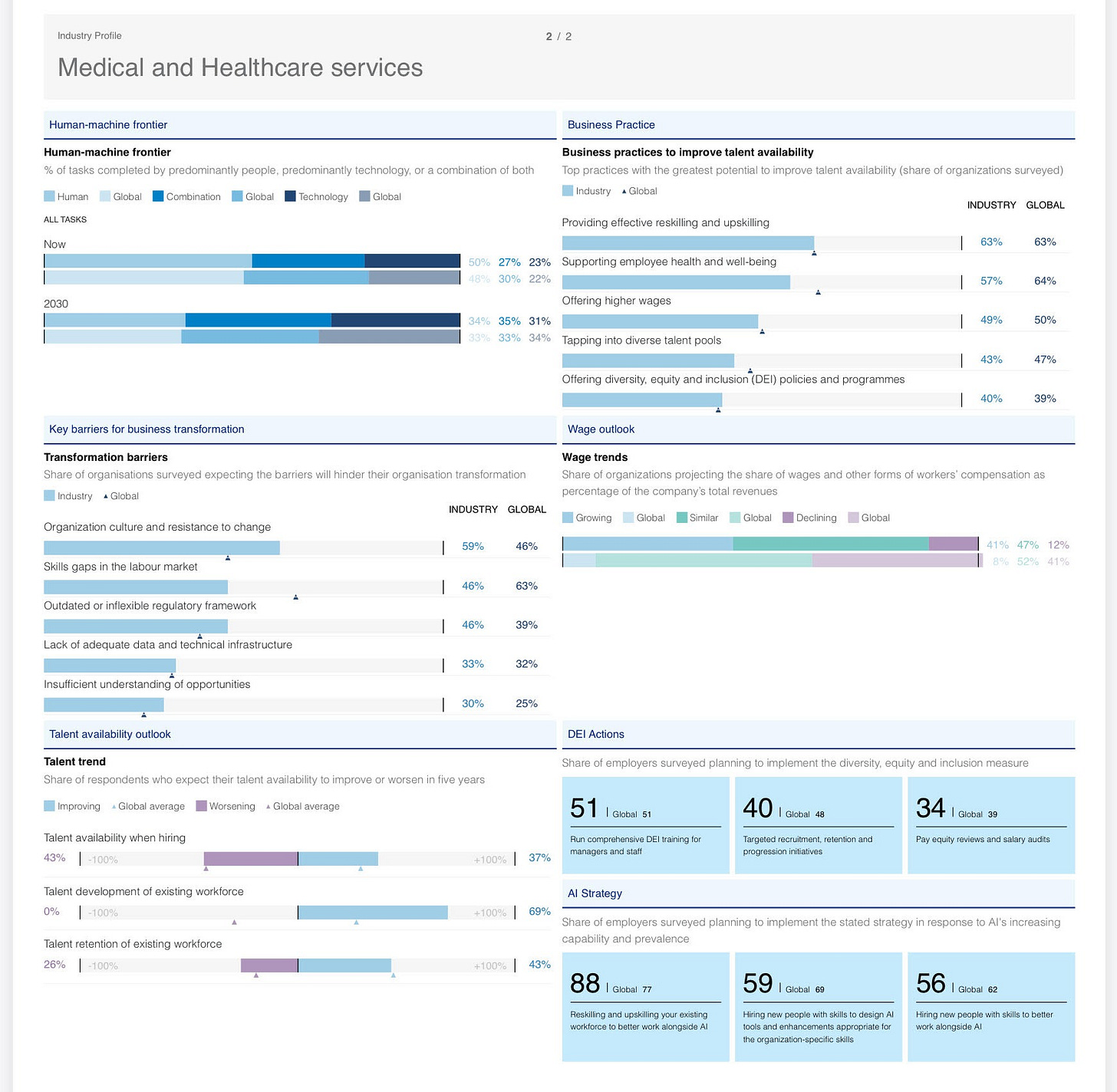

Medical and Healthcare Services

Through the Fog of Foresight is a series of notes and reflections while exploring Futures and Foresight 🔭

Written by Bülent Duagi, strategy adviser for CEOs in Tech.